Robinhood Adds Arbitrum to Its Trading Platform

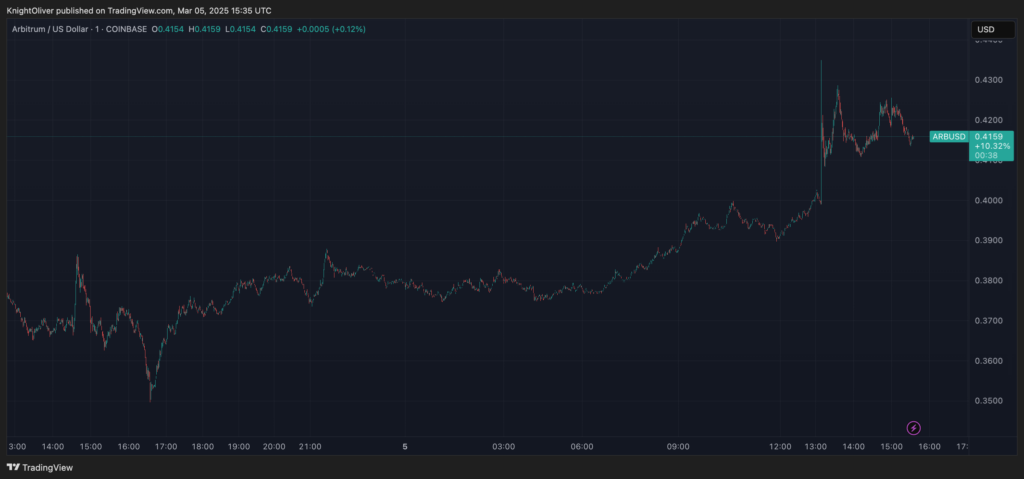

U.S.-based trading app Robinhood (HOOD) recently announced the listing of Arbitrum (ARB), leading to an impressive 12% increase in the value of the layer 2 network’s native token. This positive development has attracted significant attention from investors and traders alike.

Current Market Performance of ARB

As of now, ARB is trading at $0.42, bouncing back from an all-time low of $0.35 recorded just a day prior. The trading volume has also seen a notable uptick, rising by 10% to reach $400 million within the last 24 hours. This surge indicates a renewed interest in the token, highlighting the impact of its listing on Robinhood.

Stable Total Value Locked (TVL)

Despite fluctuations in the token’s price, the total value locked (TVL) in Arbitrum has remained relatively stable over recent weeks. Currently, the TVL stands at $2.8 billion, a significant increase from $2.5 billion at the start of November, as reported by DefiLlama. This stability reflects the underlying strength and utility of the Arbitrum network within the decentralized finance (DeFi) ecosystem.

Challenges Ahead for ARB

However, the recent rise in trading activity has not translated into a proportional increase in token price. Currently, ARB is down by 82% from its peak of $2.41 reached earlier in 2024. This decline can be attributed in part to token emissions; since March 2024, the circulating supply of ARB has surged from 1.5 billion to 4.4 billion. Consequently, while the market cap has remained more stable, the price has continued to struggle.

Competition Among Listed Tokens

Arbitrum is not alone in its debut on Robinhood; it joins a roster of other popular tokens, including XRP, Shiba Inu (SHIB), and Bonk (BONK). On the same day, these tokens experienced price increases ranging from 4.5% to 7%. Notably, Arbitrum’s extended rise compared to its counterparts may be attributed to its status as the leading layer-2 network, excelling in total value secured (TVS) and user operations per second (UOPS), according to data from L2Beat.

XRP and Other Tokens in Context

In contrast, XRP is facing challenges despite being included in Donald Trump’s U.S. strategic reserve plans, with only $80 million locked in its single XRPL decentralized exchange. Meanwhile, SHIB and BONK remain retail-focused memecoins, which may limit their long-term growth potential compared to more robust networks like Arbitrum.

In summary, while the recent listing on Robinhood has sparked a surge in interest for Arbitrum, the broader market dynamics and token emissions present ongoing challenges for ARB’s price recovery.