Understanding Bitcoin’s Recent Growth Metrics

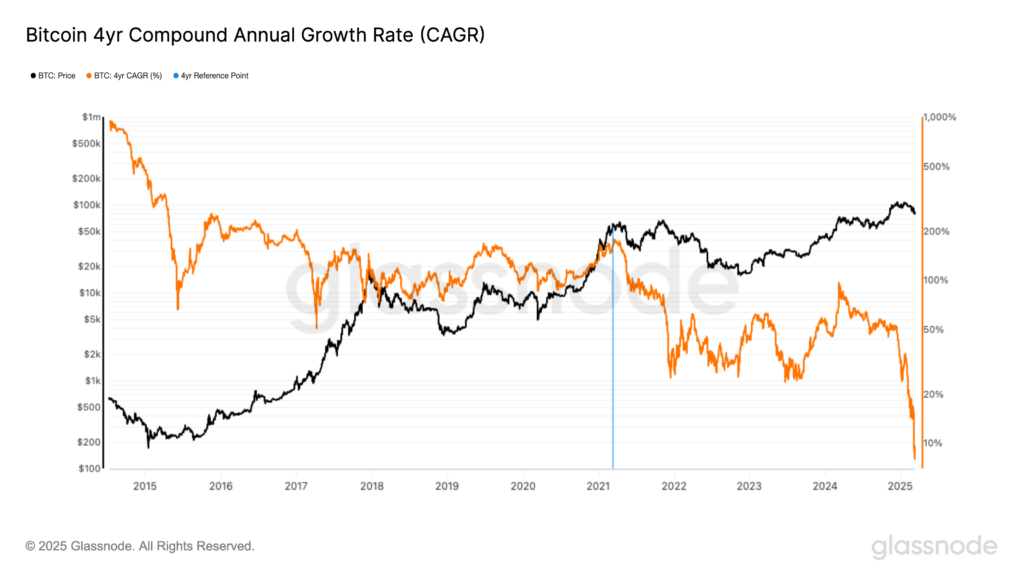

Bitcoin’s (BTC) four-year compound annual growth rate (CAGR) has reached an all-time low of just 8%, according to data compiled by Glassnode. This decline marks a significant shift in the cryptocurrency’s performance and reflects broader market trends.

The Four-Year Cycle: Halving and Market Trends

The four-year period analyzed corresponds with Bitcoin’s halving cycle, which is a pivotal event in the cryptocurrency’s ecosystem. This timeframe is also representative of the typical bull and bear market cycles that Bitcoin tends to follow.

In March 2021, Bitcoin was trading at approximately $60,000, near the apex of its previous market cycle. As the asset matures, it is expected that Bitcoin will experience a decrease in volatility and overall returns, contributing to the decline in its CAGR.

Impact of Reference Points on CAGR

It is crucial to understand that the CAGR metric is heavily influenced by the chosen reference points. In 2021, Bitcoin was riding a wave of exuberance, characterized by a blow-off top early in the cycle. Looking ahead to March 2025, the price of $80,000 could signify a market bottom, indicating the cyclical nature of cryptocurrency investments.

The Ether-Bitcoin Ratio: A Closer Look

In addition to Bitcoin’s performance, the ether (ETH) to Bitcoin (ETH/BTC) ratio has also slipped into negative CAGR territory, now sitting at 6%. This decline underscores the underperformance of Ethereum’s native token compared to Bitcoin. Since February 2021, the price of ether has remained relatively stagnant, hovering below the $2,000 mark.

Currently, the ETH/BTC ratio is at 0.024, which is its lowest point since late 2020. This trend highlights the shifting dynamics within the cryptocurrency market.

Conclusion

As the cryptocurrency landscape continues to evolve, understanding these metrics becomes increasingly important for investors. Bitcoin’s record-low CAGR and the weakening ETH/BTC ratio serve as indicators of broader market trends and the ongoing maturation of these digital assets.

Disclaimer: Parts of this article were generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, please refer to our full AI policy.