February’s Setbacks for Bitcoin

In February, Bitcoin faced considerable challenges that led to a notable decline in its risk-adjusted returns, as reported by the research firm Ecoinometrics. This downturn highlights the cryptocurrency’s increasing volatility amidst a fluctuating market landscape.

Comparative Performance: Bitcoin vs. Gold

Over the past year, Bitcoin’s overall returns have mirrored those of gold, a well-known safe-haven asset. However, when it comes to risk-adjusted returns—an essential metric that evaluates profitability in relation to price volatility—Bitcoin’s performance is aligning more closely with that of major stock indices. This shift raises questions about its stability as an investment option.

Understanding Risk-Adjusted Returns

Risk-adjusted returns serve as a critical measure for investors, as they assess an asset’s profitability in the context of its price fluctuations. A higher risk-adjusted return indicates that an asset is delivering strong returns while maintaining lower volatility, which is an attractive characteristic for many investors.

Market Dynamics and Current Trends

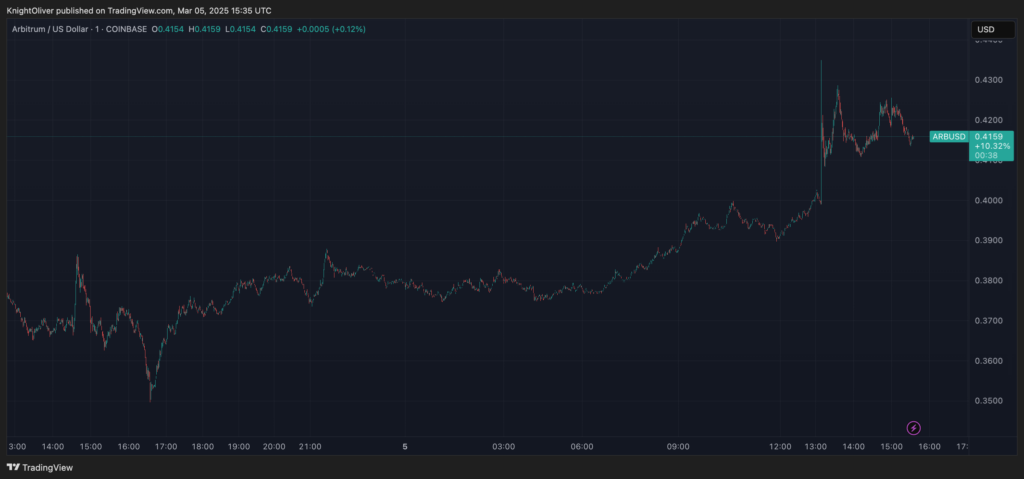

Recent market dynamics have contributed to Bitcoin’s struggles. The cryptocurrency has experienced a series of sharp price movements, influenced by various factors including trade war tensions, escalating geopolitical conflicts, and President Trump’s ambiguous statements regarding crypto regulations. As a result, Bitcoin has seen a modest decline so far in 2025, while gold has surged more than 11% year-to-date.

Analyst Insights on Bitcoin and Gold Correlation

According to CoinDesk analyst James Van Straten, the current relationship between Bitcoin and gold is notably uncorrelated. On a 20-day moving average over a five-year timeframe, their correlation has turned negative. Van Straten points out that historically, negative correlations like this often indicate that Bitcoin is nearing a bottom. Similar patterns were observed in early 2023, summer 2023, and summer 2024, suggesting that Bitcoin has the potential to realign with gold’s performance.

Implications for Institutional Investors

This recent shift in Bitcoin’s risk-adjusted returns could have significant implications for institutional investors, who typically favor assets that offer a favorable risk-reward profile. While Bitcoin’s long-term narrative as “digital gold” remains robust, its recent performance indicates a trend towards behaving more like traditional equities rather than a reliable safe-haven asset.

Conclusion

As Bitcoin navigates these turbulent waters, investors will need to closely monitor its performance and risk-adjusted returns to make informed decisions. Understanding the evolving dynamics between cryptocurrencies and traditional assets like gold will be crucial in the coming months.