By James Van Straten (All times ET unless indicated otherwise)

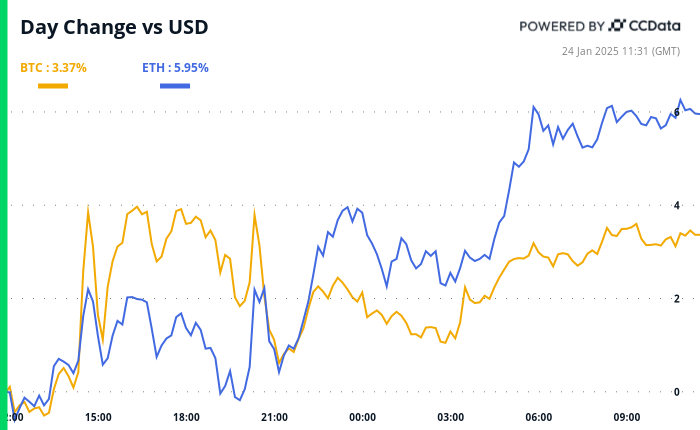

The past 24 hours have been exceptionally dynamic for the crypto market, marked by intense fluctuations in Bitcoin’s (BTC) price. The cryptocurrency swung between gains and losses of 2% to 3% at multiple intervals, yet successfully maintained its position above the important psychological threshold of $100,000, currently hovering around $105,000.

Market Influencers: The Dollar and Global Economic Trends

A notable factor contributing to the recent market movements is President Trump’s ongoing rhetoric, which appears to weaken the dollar. This trend typically supports riskier assets, including cryptocurrencies. The DXY index, which gauges the U.S. dollar’s strength against a selection of major trading partners, has dropped to its lowest level since December 17, providing a favorable environment for risk-oriented investments. Additionally, U.S. bond yields and West Texas Intermediate (WTI) crude oil prices are on the decline, with oil prices falling below $75 per barrel, marking the lowest levels in two weeks.

On an international scale, the Bank of Japan (BoJ) has followed through on its commitment to raise interest rates, increasing the policy rate to 0.50%, the highest level in over 16 years. This decision comes in response to a significant inflation report, revealing a headline inflation rate of 3.6% year-over-year—the fastest pace since January 2023. Market participants are now left wondering whether we will witness a repeat of the yen carry trade unwind experienced in August of the previous year. Time will reveal the outcome, so staying vigilant is advisable.

Upcoming Events to Keep an Eye On

**Crypto Events:**

— **January 25:** Deadline for SEC decisions on four proposed spot Solana ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF, and VanEck Solana Trust, all sponsored by Cboe BZX Exchange.

— **January 29:** Launch of the Ice Open Network (ION) mainnet.

— **February 4:** MicroStrategy Inc. (MSTR) Q4 FY 2024 earnings report.

— **February 4:** Pepecoin (PEPE) halving event; reward will decrease to 31,250 pepecoin at block 400,000.

— **February 5, 3:00 p.m.:** Boba Network’s Holocene hard fork upgrade for its Ethereum-based Layer 2 mainnet.

**Macro Events:**

— **January 24, 4:00 a.m.:** S&P Global releases the January 2025 eurozone HCOB Purchasing Managers’ Index (Flash) reports.

— **January 24, 4:30 a.m.:** S&P Global releases January 2025’s U.K. Purchasing Managers’ Index (Flash) reports.

— **January 24, 9:45 a.m.:** S&P Global releases January 2025’s U.S. Purchasing Managers’ Index (Flash) reports.

— **January 24, 10:00 a.m.:** The University of Michigan releases the January U.S. consumer sentiment data.

Token Events and Governance Updates

**Governance Votes & Calls:**

— Frax DAO is currently discussing a $5 million investment in World Liberty Financial (WLFI), a crypto project associated with the family of former President Donald Trump.

— **January 24:** Deadline for the Arbitrum BoLD activation vote, which enables public participation in validation to protect against malicious claims.

— **January 24:** Hedera (HBAR) will host a community call at 11 a.m.

**Unlocks:**

— **January 31:** Optimism (OP) will unlock 2.32% of its circulating supply, valued at $52.9 million.

— **January 31:** Jupiter (JUP) will unlock 41.5% of its circulating supply, worth $626 million.

Conferences and Events

As the crypto landscape evolves, several conferences are set to take place:

— **January 25-26:** Catstanbul 2025 in Istanbul, focusing on Jupiter, a decentralized exchange (DEX) aggregator built on Solana.

— **January 30:** International DeFi Day 2025 (online).

— **January 30-31:** Plan B Forum in San Salvador, El Salvador.

— **February 3:** Digital Assets Forum in London.

— **February 5-6:** The 14th Global Blockchain Congress in Dubai.

— **February 6:** Ondo Summit 2025 in New York.

— **February 7:** Solana APEX in Mexico City.

— **February 13-14:** The 4th Edition of NFT Paris.

— **February 18-20:** Consensus Hong Kong.

— **February 19:** Sui Connect in Hong Kong.

— **February 23 to March 2:** ETHDenver 2025 in Denver.

— **February 25:** HederaCon 2025 in Denver.

Token Talk: New Ventures and Trends

In a lighthearted twist in the crypto space, a new decentralized autonomous organization (DAO) named FartStrategy (FSTR) is investing user funds into FARTCOIN. This initiative uses borrowed SOL to acquire the token, allowing investors to gain exposure to its price movements. Should FSTR’s trading value fall below its FARTCOIN backing, token holders can vote to dissolve the DAO and redeem their share of FARTCOIN proportionally after settling any debts.

Additionally, the VINE memecoin made headlines by reaching a market capitalization of $200 million within just 48 hours of its launch. Created by Rus Yusupov, a co-founder of the original Vine app, this token serves as a nostalgic tribute to the beloved platform known for its six-second looping videos.

Market Overview: Current Movements and Trends

As of the latest data, Bitcoin has shown a 2% increase from 4 p.m. ET Thursday, currently at $105,450.57, with a 24-hour gain of 3.43%. Ethereum (ETH) has risen 4.96% to $3,409.62, and the CoinDesk 20 index is up 2.4%, reaching 3,988.16. The CESR Composite Staking Rate has increased slightly to 3.16%, while Bitcoin’s funding rate on Binance is at 0.0069% (7.58% annualized).

Technical Analysis Insights

Recent analysis of Ether suggests it has formed a falling wedge pattern, characterized by two converging trendlines that indicate a series of lower highs and lower lows. The converging nature of these trendlines signals that sellers may be losing their grip on the market, hinting at a potential bullish trend reversal with a breakout.

Crypto Equities Performance

The performance of various crypto-related equities is as follows:

— **MicroStrategy (MSTR):** Closed at $373.12, down 1.11%, but up 2.55% in pre-market trading at $382.62.

— **Coinbase Global (COIN):** Closed at $296.01, up 0.05%, and increased by 2.16% in pre-market trading at $302.39.

— **Galaxy Digital Holdings (GLXY):** Closed at C$33.94, up 3.44%.

— **MARA Holdings (MARA):** Closed at $19.95, up 1.32%, and rose 1.8% in pre-market trading at $20.31.

— **Riot Platforms (RIOT):** Closed at $12.99, down 1.14%, but increased by 2.62% in pre-market trading at $13.33.

ETF Flows and Insights

**Spot BTC ETFs:**

— **Daily Net Flow:** $188.7 million.

— **Cumulative Net Flows:** $39.42 billion.

— **Total BTC Holdings:** Approximately 1.169 million.

**Spot ETH ETFs:**

— **Daily Net Flow:** -$14.9 million.

— **Cumulative Net Flows:** $2.79 billion.

— **Total ETH Holdings:** Approximately 3.663 million.

Chart of the Day: Stablecoin Market Dynamics

The market capitalization of Tether’s USDT, the largest dollar-pegged stablecoin, has stabilized around $138 billion. Meanwhile, the supply of USDC has seen an uptick, reaching nearly $52 billion this week, the highest level since September 2022.

In Summary: Key Developments and Global Insights

Bitcoin has remained steady in the vicinity of $104,000 despite the Bank of Japan’s hawkish rate hike. Markets are closely monitoring President Trump’s recent executive order on cryptocurrencies and potential shifts in U.S. policy.

Additionally, Vitalik Buterin, co-founder of Ethereum, has called for enhanced focus on Ether as part of the network’s scaling strategy, while U.S. stocks are witnessing record valuations relative to bonds, reflecting soaring demand for leading tech companies.

As the crypto landscape unfolds, these developments will continue to shape the market dynamics, making it crucial for investors to stay informed and agile.