By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin’s Ongoing Downtrend

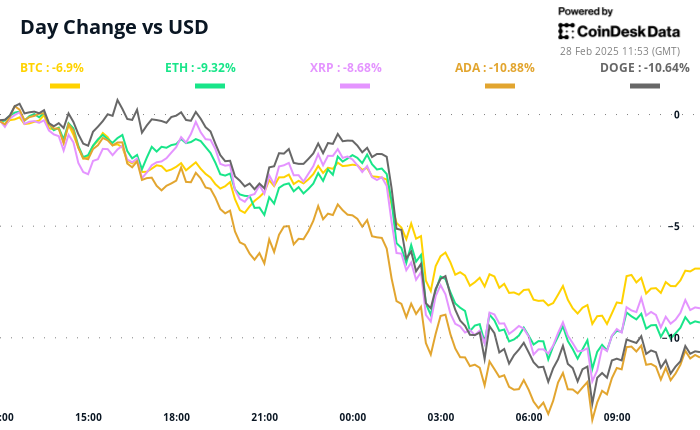

Bitcoin’s slump continues as it dipped below $80,000 early Friday, marking a staggering decline of over 20% for February alone. This downturn triggered a sharp sell-off across the entire cryptocurrency market, dragging ether down to below $2,100, a significant support level it had maintained since August.

Broader Market Volatility

The heightened volatility in the crypto space is reflective of shifts in traditional financial markets. The Volmex BVIV index, which gauges the 30-day implied volatility of Bitcoin, surged by 10%. This spike mirrored an equal increase in the MOVE index, which measures the volatility of U.S. Treasury notes. Additionally, the VIX, often referred to as Wall Street’s fear gauge, rose by 14%, signaling growing unease among investors.

Increased fluctuations in growth-sensitive currencies such as the Australian, New Zealand, and Canadian dollars further indicate macroeconomic jitters. Concerns over potential tariffs from former President Trump have prompted investors to pivot toward safer, less volatile assets.

Expert Insights on Market Trends

Griffin Ardern, head of options trading at crypto financial platform BloFin, noted, «U.S. domestic policies have become unstable, and the White House seems keen to capitalize on this instability. Given the difficulties investors face in securing reliable forward-looking guidance, many are leaning towards low-volatility assets. Traders are liquidating positions to minimize exposure before transitioning to other markets, which explains the widespread declines across asset classes, including cryptocurrencies.»

Anticipating Continued Volatility

The volatility is likely to persist, especially with President Donald Trump expected to address the public later today. Investors hoping for a rebound in risk assets based on personal consumption statistics may find their optimism misplaced, as expected soft readings could be overshadowed by tariff concerns and rising inflation indicators.

Positive Developments Amidst Gloom

Despite the bleak outlook, there are signs of optimism as the macroeconomic landscape stabilizes. This week, the regulatory environment showed potential for improvement, with the SEC dropping charges against Uniswap, a leading decentralized exchange, and considering similar actions regarding its issues with Consensys.

Evgeny Gaevoy, CEO of market maker Wintermute, highlighted that many are overlooking the SEC’s evolving stance, a factor the market has yet to fully price in. Additionally, the decline in the basis for CME Bitcoin and ether futures, which indicates weakening demand, has leveled off, and Bitcoin is approaching a potential demand zone from a technical analysis perspective. Staying vigilant is crucial in these times!

Upcoming Key Events

**Crypto Events:**

— **March 1:** Spot trading on Arkham Exchange launches in 17 U.S. states.

— **March 5, 2:29 a.m.:** Ethereum testnet Sepolia to undergo Pectra hard fork upgrade.

— **March 15:** Athene Network (ATH) mainnet launch.

— **March 24, 11:00 a.m.:** Bugis network upgrade on Enjin Matrixchain mainnet.

**Macro Events:**

— **Feb. 28, 8:30 a.m.:** U.S. Bureau of Economic Analysis to release January personal consumption and expenditure data.

— Core PCE Price Index MoM: Est. 0.3% vs. Prev. 0.2%

— Core PCE Price Index YoY: Est. 2.6% vs. Prev. 2.8%

— PCE Price Index MoM: Est. 0.3% vs. Prev. 0.3%

— PCE Price Index YoY: Est. 2.5% vs. Prev. 2.6%

— Personal Income MoM: Est. 0.3% vs. Prev. 0.4%

— Personal Spending MoM: Est. 0.1% vs. Prev. 0.7%

— **March 2, 8:45 p.m.:** Caixin and S&P Global to release February manufacturing data from China.

**Earnings Announcements:**

— **March 6 (TBC):** Bitfarms (BITF), $-0.04

— **March 17 (TBC):** Bit Digital (BTBT), $-0.05

— **March 18 (TBC):** TeraWulf (WULF), $-0.03

— **March 24 (TBC):** Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Developments

**Governance Votes & Proposals:**

— Sky DAO is contemplating reducing Smart Burn Engine activity, which will lower SKY token buybacks from around $1 million to $400,000 daily.

— Lido DAO is discussing an SSV Lido Module (SSVLM) proposal to distribute staking rewards to node operators.

**Unlock Events:**

— **March 1:** DYdX to unlock 1.14% of circulating supply (~$5.58 million).

— **March 1:** ZetaChain (ZETA) to unlock 6.48% (~$12.45 million).

— **March 1:** Sui (SUI) to unlock 0.74% (~$60.40 million).

— **March 2:** Ethena (ENA) to unlock 1.3% (~$15.91 million).

— **March 7:** Kaspa (KAS) to unlock 0.63% (~$12.35 million).

— **March 8:** Berachain (BERA) to unlock 9.28% (~$73.80 million).

— **March 9:** Movement (MOVE) to unlock 2.08% (~$21.4 million).

**Token Listings:**

— **Feb. 28:** Worldcoin (WLD) to be listed on Kraken.

— **Feb. 28:** Zcash (ZEC) and Dash (DASH) are scheduled for delisting from Bybit.

Conferences to Attend

— CoinDesk’s Consensus in Toronto: May 14-16 (Use code DAYBOOK for 15% off).

— ETHDenver 2025 (Denver): Ongoing.

— Crypto Expo Europe (Bucharest): March 2-3.

— Bitcoin Alive (Sydney): March 8.

— MoneyLIVE Summit (London): March 10-11.

— Web3 Amsterdam ‘25 (Netherlands): March 13-14.

— Next Block Expo (Warsaw): March 19-20.

— DC Blockchain Summit 2025 (Washington): March 26.

— Solana APEX (Cape Town): March 28.

Market Dynamics and Trends

The North Korea-supported Lazarus Group is reportedly laundering over $240 million in ether via THORChain, a decentralized cross-chain swap protocol, primarily converting it to Bitcoin. THORChain facilitates cross-chain swaps without wrapping assets, ensuring user custody and fund security.

**Derivatives Positioning:**

TRX and TRON are currently witnessing negative perpetual funding rates, indicating a dominance of bearish positions. Meanwhile, most other major cryptocurrencies still hold positive funding rates. On decentralized exchange Derive.xyz, ETH’s options skew for both 7-day and 30-day options has sharply declined, reflecting a strong bias for protective puts.

Market sentiment is evident through the pricing of Bitcoin options on Derive, indicating a 44% probability of BTC settling below $80K by the end of June, with only a 3.5% chance of prices soaring to $150K, showcasing the prevailing fear within the market. On Deribit, BTC and ETH options also indicate a preference for puts through April expirations.

Market Movements Snapshot

— BTC: down 3.3% to $80,552.45 (-7.09% in 24hrs).

— ETH: down 4.62% to $2,135.58 (-9.3% in 24hrs).

— CoinDesk 20 index: down 4.63% to 2,821.02 (-8.31% in 24hrs).

— Ether CESR Composite Staking Rate: up 4 bps to 3.06%.

— BTC funding rate on Binance: 0.0069% (annualized 7.55%).

**Global Market Indices:**

— DXY: unchanged at 107.32.

— Gold: down 0.77% to $2,863.13/oz.

— Silver: down 1.09% to $31.15/oz.

— Nikkei 225: closed down 2.88%.

— Hang Seng: closed down 3.28%.

— FTSE: up 0.25%.

— Euro Stoxx 50: down 0.49%.

— DJIA: closed down 0.45%.

— S&P 500: closed down 1.59%.

— Nasdaq: closed down 2.78%.

— S&P/TSX Composite Index: closed down 0.79%.

— S&P 40 Latin America: closed down 1.36%.

— U.S. 10-year Treasury rate: down 2 bps to 4.26%.

— E-mini S&P 500 futures: up 0.34%.

— E-mini Nasdaq-100 futures: up 0.3%.

— E-mini Dow Jones Industrial Average futures: up 0.33%.

Bitcoin Statistics Overview

— BTC Dominance: 60.51 (-0.41%).

— Ethereum to Bitcoin ratio: 0.02681 (-1.58%).

— Hashrate (7-day moving average): 844 EH/s.

— Hashprice (spot): $48.1.

— Total Fees: 8.38 BTC / $715,412.

— CME Futures Open Interest: 155,245 BTC.

— BTC priced in gold: 27.5 oz.

— BTC vs. gold market cap: 7.80%.

Technical Analysis Insights

Ether is currently at a critical support level of $2,100, having experienced seller exhaustion several times since last August. Should this support level fail, it may trigger further selling from long-term holders, potentially leading to a more significant decline.

Performance of Crypto Equities

— MicroStrategy (MSTR): closed at $240.05 (-8.82%), down 1.99% in pre-market at $235.28.

— Coinbase Global (COIN): closed at $208.37 (-2.16%), down 3.64% to $200.78 pre-market.

— Galaxy Digital Holdings (GLXY): closed at C$20.28 (+0.6%).

— MARA Holdings (MARA): closed at $13.13 (+5.46%), down 3.43% to $12.68.

— Riot Platforms (RIOT): closed at $8.66 (-3.13%), down 3.35% to $8.37.

— Core Scientific (CORZ): closed at $10.71 (+6.89%), down 2.24% to $10.47.

— CleanSpark (CLSK): closed at $7.51 (-4.7%), down 2.4% to $7.33.

— CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.89 (-1.92%).

— Semler Scientific (SMLR): closed at $40.63 (-7.47%), down 3.03% to $39.40.

— Exodus Movement (EXOD): closed at $42.20 (-5.13%), up slightly to $42.42.

ETF Flows Analysis

**Spot BTC ETFs:**

— Daily net flow: -$275.9 million.

— Cumulative net flows: $36.85 billion.

— Total BTC holdings: ~1,132 million.

**Spot ETH ETFs:**

— Daily net flow: -$71.2 million.

— Cumulative net flows: $2.86 billion.

— Total ETH holdings: ~3.702 million.

Overnight Market Trends

Bitcoin’s dramatic fall to $80K and XRP’s loss of critical support coincided with Trump tariff announcements and a rise in the Dollar Index.

**Related Headlines:**

— President Trump announced a 25% tariff on imports from Canada and Mexico, alongside a 10% tariff on Chinese imports set to take effect on March 4.

— A potential sell-off in Bitcoin could represent a typical ‘breakout and retest’ scenario.

— Trump’s tariff strategy is facing delays, with full implementation expected to take months.

— China has vowed to retaliate against new U.S. tariffs.

— The British pound is showing resilience against stronger economic data compared to U.S. tariffs.

— Mexico has extradited major drug cartel figures to the U.S. amid tariff threats.

In Conclusion

The crypto landscape remains turbulent, with Bitcoin and other cryptocurrencies facing significant headwinds. However, potential positive regulatory developments and a long-term outlook may provide some hope for investors. Stay tuned for upcoming events and market shifts as we navigate these challenging times.