By Omkar Godbole (All times ET unless indicated otherwise)

The Current State of the Crypto Market

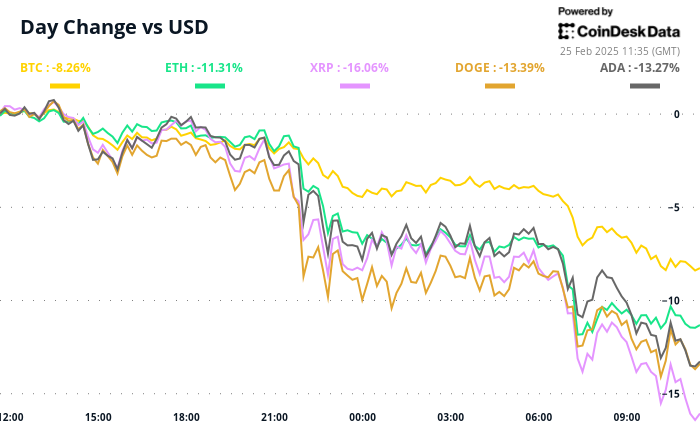

The cryptocurrency market is currently experiencing significant downward pressure, with Bitcoin trading at its lowest point in three months, falling below $88,000. The CoinDesk 20 Index has also taken a hit, plummeting over 10% in just 24 hours. This dramatic decline can be attributed to various factors, including a risk-off sentiment permeating traditional markets and the influence of memecoins, particularly TRUMP and LIBRA.

Concerns from the Consensus Conference

Market makers who attended the Consensus Hong Kong conference last week expressed apprehension that the ongoing memecoin frenzy had siphoned liquidity from more productive sectors of the crypto market. This has left the broader market vulnerable to sudden downturns, contributing to the recent price drops.

Political Factors Impacting Crypto Sentiment

Another catalyst for the downturn is the perceived inaction from former President Donald Trump. Despite making bold promises ahead of the elections, substantial follow-through has been lacking. The anticipated establishment of a Bitcoin Strategic Reserve remains unrealized, and efforts to implement state-level reserves have proven challenging.

Petr Kozyakov, co-founder and CEO of Mercuryo, emphasized the industry’s need for concrete measures: «The industry is still waiting for this to manifest in a tangible way.» The recent hack at Bybit, where 401,000 ETH was leaked, further eroded investor confidence, coupled with rampant pump and dump schemes prevalent in the memecoin market.

Economic Indicators and Their Effects

Fresh concerns regarding the U.S. economy are also dampening demand for riskier assets. Aurelie Barthere, principal research analyst at Nansen, noted, «There is also some concern about the slowdown in U.S. growth since last week’s U.S. Services PMI release, the lowest in 22 months.» The Nansen Risk Barometer has shifted to a risk-off stance from neutral, reinforcing apprehensions about market stability.

Technical Analysis and Future Projections

The combined effects of these factors have pushed Bitcoin out of its two-month trading range between $90,000 and $110,000. Technical analysis suggests that Bitcoin could decline to $70,000, although there is a significant open interest in BTC put options on Deribit at the $80,000 level, which might offer some support.

Potential Stabilizing Factors

What could help stabilize the market? A strategic reserve announcement from Trump or a rebound in the Nasdaq 100 could provide a much-needed boost. However, the Nasdaq has recently fallen below its 50-day simple moving average, while the Japanese yen, a traditional indicator of risk aversion, is strengthening against G7 currencies, including the dollar.

Upcoming Catalysts to Watch

The next major catalysts for risk assets include Nvidia’s earnings report scheduled for February 26 and the core PCE inflation data set for release on February 28. Investors should remain vigilant as these events unfold.

Key Events to Monitor

In the crypto space:

— February 25, 9:00 a.m.: Ethereum Foundation research team AMA on Reddit.

— February 25: Pascal hard fork network upgrade goes live on the BNB Smart Chain testnet.

— February 25, 9:00 a.m.: Reactive Network mainnet launch and REACT token distribution.

— February 26, 9:00 a.m.: Cosmos network upgrade.

— February 26: RedStone farming starts on Binance Launchpool.

— February 27, 4:00 a.m.: Alchemy Pay community AMA on Discord.

— February 27: Solana-based Sonic SVM mainnet launch.

In macroeconomic news:

— February 25, 10:00 a.m.: Consumer Confidence Index release.

— February 25, 1:00 p.m.: Speech by Richmond Fed President Tom Barkin on inflation.

— February 25, 7:30 p.m.: Release of January’s Consumer Price Index by the Australian Bureau of Statistics.

— February 26, 10:00 a.m.: U.S. Census Bureau’s New Residential Sales report.

Corporate Earnings:

— February 25: Bitdeer Technologies Group and Cipher Mining pre-market earnings.

— February 26: MARA Holdings and NVIDIA post-market earnings.

Governance Decisions and Unlocks

Governance votes and discussions are active in various DAOs:

— Ampleforth DAO is voting on reducing Flash Mint and Redeem fees.

— DYdX DAO is contemplating a buyback program using 25% of net revenue.

— Frax DAO is discussing protocol upgrades, including renaming FXS to FRAX and implementing a Tail Emission Plan.

Upcoming Unlocks:

— February 28: Optimism to unlock 2.32% of circulating supply worth $30.21 million.

— March 1: DYdX and ZetaChain unlocks worth $5.36 million and $11.86 million, respectively.

Conferences and Networking

CoinDesk’s Consensus conference is set to occur in Toronto from May 14-16. Use code DAYBOOK for a 15% discount on passes. Other upcoming events include ETHDenver, Crypto Expo Europe, and more, providing opportunities for networking and learning within the crypto community.

Scams and Memecoin Issues

In recent news, a memecoin linked to a fraudulent Sam Bankman-Fried account became the latest rug pull. The account, masquerading as a verified government entity, launched a memecoin that briefly gained a market cap of $10 million before the creators withdrew liquidity, leaving investors with significant losses.

Market Dynamics and Sentiment

The top 25 cryptocurrencies by market value, excluding stablecoins, have experienced significant losses in the past 24 hours. An influx of bearish short positions suggests that more pain could be ahead. On Deribit, XRP’s February expiry puts are trading at a premium compared to calls, indicating a notably bearish sentiment in the market.

Market Movements Overview

As of the latest updates:

— Bitcoin (BTC) is down 6.23% at $88,118.16.

— Ethereum (ETH) has decreased by 9.4% to $2,393.03.

— The CoinDesk 20 index has lost 9.19%, now at 2,750.01.

Market Stats:

— BTC Dominance: 61.81%

— Hashrate: 745 EH/s

— Total Fees: 7.5 BTC / $1.3 million

Technical Analysis Insights

The daily chart for Bitcoin indicates a bearish reversal, suggesting potential weakness towards the 200-day simple moving average currently below $82,000.

Crypto Equities Snapshot

Several crypto-related equities have also suffered declines, with MicroStrategy and Coinbase experiencing significant losses. The market is reacting to the broader downturn in the cryptocurrency space.

ETF Flows and Performance

Spot BTC ETFs have seen notable outflows, with a daily net flow of -$516.4 million and total BTC holdings around 1,105 million. Spot ETH ETFs also reported outflows, reflecting the current market sentiment.

Looking Ahead

As we navigate a challenging market landscape, all eyes will be on upcoming economic data releases and corporate earnings that could shift the momentum in the crypto space. Stay tuned for further updates as the situation evolves.