By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin’s Stability Amid Tariff Tensions

As President Donald Trump prepares to announce a 25% tariff on steel and aluminum imports, Bitcoin (BTC) shows remarkable resilience. Despite the escalating trade rhetoric, BTC remains steady, buoyed by favorable signals from foreign exchange markets, particularly the AUD/JPY pair. The current market sentiment stands in stark contrast to the previous week’s heightened risk aversion following Trump’s initial tariff threats.

Market analysts suggest that traders may perceive Trump’s aggressive tariff strategy as a negotiating tactic rather than a firm commitment to prolonged tariffs. This theory gained traction after Trump’s recent decision to suspend tariffs on Mexico and Canada for 30 days, indicating a more calculated approach to trade negotiations.

QCP Capital has highlighted this evolving dynamic, noting a potential feedback loop where Trump’s sensitivity to market reactions could lead him to adopt a more confrontational stance. “As the market increasingly calls his bluff, he may feel emboldened, resulting in heightened volatility,” QCP stated in a recent Telegram update. The unfolding situation warrants close observation.

Trends in Ethereum Futures and Market Developments

A significant social media trend has emerged, showcasing record short positions in CME-listed cash-settled ether futures. Interestingly, these shorts are not outright bearish bets; they likely form part of carry trades, where investors maintain long positions in ETFs while shorting CME futures. Notably, inflows into Ethereum (ETH) ETFs surged last week, suggesting some investors are hedging against potential downturns in altcoins, especially with a looming influx of new coins.

In a positive development over the weekend, Kabir.Base.eth, a member of the Base network, dispelled rumors that Coinbase was liquidating ETH earned from transaction fees, adding a layer of transparency to the exchange’s operations.

In an exciting turn of events, the president of the Central African Republic, Archange Touadéra, has reportedly launched a new memecoin. The coin’s early trading activity saw one investor transform a $5,000 investment into an astonishing $12 million within three hours, representing a staggering return of 2,450x, as per LookOnChain data.

Litecoin Shines Bright

Meanwhile, Litecoin (LTC) has emerged as the leading cryptocurrency over the past 24 hours, posting a remarkable 9% increase. This performance is noteworthy in the context of broader market movements.

Macroeconomic Influences on the Crypto Landscape

On the macroeconomic front, rising U.S. consumer inflation expectations are raising concerns about the possibility of a prolonged pause in the Federal Reserve’s rate cuts. Investors should be particularly attentive to the upcoming Consumer Price Index (CPI) report scheduled for release on Wednesday.

What to Watch in the Coming Days

Crypto Events:

— **Feb. 13:** Kraken will begin the gradual delisting of USDT, PYUSD, EURT, TUSD, and UST stablecoins for EEA clients, concluding on March 31.

— **Feb. 14:** The Dynamic TAO (DTAO) network upgrade will go live on the Bittensor (TAO) mainnet.

— **Feb. 14, 2:30 a.m. (Estimate):** The Qtum (QTUM) hard fork network upgrade will take place.

— **Feb. 18, 10:00 a.m.:** FTX Digital Markets, based in the Bahamas, will commence reimbursing creditors.

— **Feb. 21:** The Open Network (TON) will serve as the exclusive blockchain infrastructure for Telegram’s Mini App ecosystem.

Macro Events:

— **Feb. 11, 2:30 p.m.:** U.S. House Financial Services Subcommittee hearing titled «A Golden Age of Digital Assets: Charting a Path Forward,» featuring witness Jonathan Jachym from Kraken.

— **Feb. 12, 8:30 a.m.:** The Bureau of Labor Statistics (BLS) will release January’s CPI report.

— **Feb. 12, 10:00 a.m.:** Fed Chair Jerome Powell will present his semi-annual report to the U.S. House Financial Services Committee.

— **Feb. 13, 8:30 a.m.:** The BLS will release January’s Producer Price Index (PPI) report.

Earnings:

— **Feb. 10:** Canaan (CAN), pre-market, expected at $-0.08.

— **Feb. 11:** HIVE Digital Technologies (HIVE), post-market, expected at $-0.15.

— **Feb. 12:** Hut 8 (HUT), pre-market, expected at $0.05, among others.

Governance and Token Events

The Aave DAO is currently deliberating on recognizing HyperLend as a friendly fork of Aave and the deployment of Aave v3 on Kraken’s layer-2 rollup network. In addition, Sky DAO is discussing onboarding Arbitrum One to the Spark Liquidity layer and minting 100 million USDS worth of sUSDS into Base to accommodate network growth.

Recent Unlocks:

— **Feb. 10:** Aptos (APT) will unlock 1.97% of its circulating supply, valued at $71.14 million.

— **Feb. 10:** Berachain (BERA) will unlock 12.08% of its circulating supply, valued at $66.07 million.

— **Feb. 14:** The Sandbox (SAND) will unlock 8.4% of its circulating supply, worth $80.2 million.

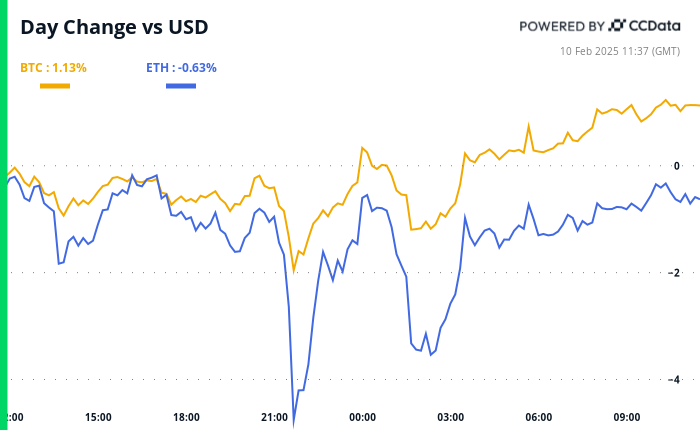

Market Movements and Key Statistics

Bitcoin’s recent performance shows a modest increase of 1.80% from Friday, bringing its price to $97,805.98. In contrast, Ethereum has dipped by 0.79%, currently trading at $2,647.53. The CoinDesk 20 index has risen by 2.92% to 3,209.42, reflecting a slight upward trend in the overall market.

Key Statistics:

— **BTC Dominance:** 61.70%

— **Ethereum to Bitcoin Ratio:** 0.02717

— **Hashrate (7-day moving average):** 808 EH/s

— **CME Futures Open Interest:** 164,510

Technical Analysis Overview

Recent technical analysis indicates that shares of MicroStrategy (MSTR) have broken out of a mini rising channel, potentially signaling the end of a bounce from the December 31 low. Prices are now solidly below the 38.2% Fibonacci retracement level, a critical indicator in maintaining a bullish trend.

Crypto Equities Snapshot

— **MicroStrategy (MSTR):** Closed at $327.56 (+0.56%).

— **Coinbase Global (COIN):** Closed at $274.49 (+1.52%).

— **Galaxy Digital Holdings (GLXY):** Closed at C$26.89 (-0.66%).

— **MARA Holdings (MARA):** Closed at $16.77 (-0.18%).

ETF Flows and Overnight Updates

Recent data indicates substantial inflows into spot BTC ETFs, contributing a daily net flow of $171.3 million and a cumulative total of $40.70 billion. Meanwhile, spot ETH ETFs reported no new flows.

In summary, as the crypto landscape evolves with ongoing trade tensions and macroeconomic shifts, the resilience of Bitcoin and the movements in altcoins will be crucial to monitor in the coming days. The market’s response to these developments will unfold, providing insights into the future trajectory of cryptocurrencies.