By Francisco Rodrigues (All times ET unless indicated otherwise)

Market Overview: Deleveraging Trends in Cryptocurrency

Crypto traders are currently in a phase of deleveraging following the release of the Federal Open Market Committee (FOMC) minutes on Wednesday, indicating that the Federal Reserve plans to maintain steady interest rates until inflation shows signs of improvement. The discussion also included potential pauses or reductions in balance sheet runoff, which has influenced market sentiments.

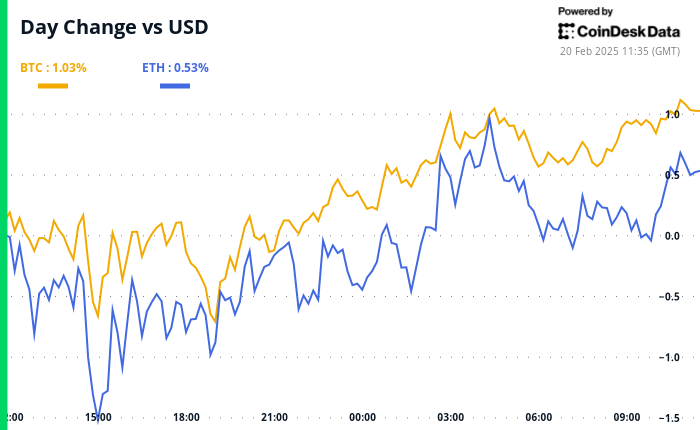

Despite this, the yield on the 10-year Treasury bond has dropped, and the U.S. dollar has weakened, resulting in a positive turn for cryptocurrencies. The CoinDesk 20 Index has risen by 1.4%, with Bitcoin itself gaining 1.2% over the past 24 hours. This uptick can be attributed to supportive comments from notable figures, including Czech National Bank Governor Ales Michl, who championed Bitcoin as a reserve asset, and former President Donald Trump, who claimed to have ended what he called “Joe Biden’s war on Bitcoin and crypto.”

Current Trading Sentiments and Market Dynamics

As Bitcoin prices hover around $97,000, traders are adopting a cautious approach, largely due to dwindling demand, stagnant blockchain activity, and decreasing liquidity inflows. Concerns are mounting that Bitcoin may retract to $86,000. This cautious stance is reflected in declining volatility and a significant drop in open interest across Bitcoin futures contracts.

Recent data from Coinglass reveals that open interest has decreased to below $60 billion, down from nearly $70 billion in late January. This decline coincides with a cooling-off period following the recent memecoin craze, which was notably impacted by Argentina’s Libra debacle, resulting in diminished enthusiasm for speculative assets.

David Gogel, the VP of Strategy and Operations at the dYdX Foundation, commented, “Right now, the market is in a bit of a cooldown phase. Bitcoin has been holding up, but after failing to break past $105k in January, we’ve seen capital inflows slow down, and speculative assets like Solana and memecoins take a hit.”

The negative trend is particularly evident in the Solana blockchain’s native token, SOL, where open interest for futures contracts has plummeted from approximately $6 billion last month to around $4.3 billion currently.

Geopolitical Considerations and Market Outlook

Traders are advised to remain vigilant regarding broader macroeconomic factors and geopolitical developments that could influence market movements. Notably, rising tensions between Trump and Ukrainian President Volodymyr Zelensky have sparked public exchanges that could have implications for market sentiment.

The current trend of declining leverage and a shift away from riskier investments suggests the cryptocurrency market may be transitioning into a new phase. However, the specifics of this phase remain uncertain, so staying alert is crucial for traders.

Upcoming Events to Keep an Eye On

**Crypto Events:**

— February 21: TON (The Open Network) will serve as the exclusive blockchain infrastructure for Telegram’s Mini App ecosystem.

— February 24: Testing for Ethereum’s Pecta upgrade on the Holesky testnet will commence at epoch 115968.

— February 25, 9:00 a.m.: Ethereum Foundation research team will host an AMA on Reddit.

— February 27: Mainnet launch of Solana-based L2 Sonic SVM (SONIC), titled “Mobius.”

**Macro Events:**

— February 20, 8:30 a.m.: Statistics Canada will report January’s producer price inflation data.

— February 20, 8:30 a.m.: The U.S. Department of Labor will announce Unemployment Insurance Weekly Claims for the week ending February 15.

— February 20, 5:00 p.m.: Fed Governor Adriana D. Kugler will deliver a speech titled «Navigating Inflation Waves While Riding on the Phillips Curve.»

— February 20, 6:30 p.m.: Japan’s Ministry of Internal Affairs will report January’s consumer price inflation data.

Token Governance and Unlocks

**Governance Votes:**

— Sky DAO is considering withdrawing a portion of the Smart Burn Engine’s LP tokens to prevent malicious acquisitions.

— DYdX DAO is discussing increasing the maximum notional value for liquidations on the dYdX protocol to improve efficiency during such events.

**Unlock Dates:**

— February 21: Fast Token (FTN) will unlock 4.66% of its circulating supply, valued at $78.6 million.

— February 28: Optimism (OP) will unlock 1.92% of its circulating supply, valued at $34.23 million.

— March 1: Sui (SUI) will unlock 0.74% of its circulating supply, valued at $81.07 million.

Conferences and Networking Opportunities

CoinDesk’s Consensus will take place in Hong Kong from February 18-20 and in Toronto from May 14-16. Attendees can use code DAYBOOK for a 15% discount on passes.

**Upcoming Conferences:**

— February 23-March 2: ETHDenver 2025 (Denver)

— February 24: RWA London Summit 2025

— February 25: HederaCon 2025 (Denver)

— March 2-3: Crypto Expo Europe (Bucharest, Romania)

— March 8: Bitcoin Alive (Sydney, Australia)

Market Movements and Statistics

In the latest market movement update, Bitcoin has increased by 1.10% since Wednesday at 4 p.m. ET, reaching $97,300.67. Ethereum has gained 0.60%, trading at $2,738.90. The CoinDesk 20 Index shows an overall increase of 1.72%.

**Key Market Indicators:**

— BTC Dominance: 61.10%

— Ethereum to Bitcoin Ratio: 0.02819

— Hashrate (7-day moving average): 831 EH/s

— CME Futures Open Interest: 172,360 BTC

Technical Analysis Insights

Bitcoin has managed to rebound from the yearly low of $93,385, reclaiming the 100-day exponential moving average. Recent sell-offs have formed higher lows, indicating strong buyer interest at current price levels. However, caution is advised, as the short-term 20-day and 50-day EMAs have crossed for the first time since August 5.

Crypto Equities Performance

**Recent Equity Performance:**

— MicroStrategy (MSTR): Closed at $318.67 (-4.58%), currently trading at $325.08 in pre-market.

— Coinbase Global (COIN): Closed at $258.67 (-2.25%), now at $263.22.

— Galaxy Digital Holdings (GLXY): Closed at C$25.32 (-3.76%).

— Riot Platforms (RIOT): Closed at $11.56 (unchanged), now at $11.68.

ETF Flows and Market Dynamics

**Spot BTC ETFs:**

— Daily Net Flow: -$64.1 million

— Total BTC Holdings: ~1.170 million

**Spot ETH ETFs:**

— Daily Net Flow: $19 million

— Total ETH Holdings: ~3.795 million

Insights from Overnight Market Activity

Recent research indicates that the LIBRA memecoin fiasco has led to a staggering loss of $251 million in investor wealth, with 86% of traders suffering losses. Meanwhile, Hong Kong’s efforts to expand its virtual assets market are gaining traction, as outlined by the SFC CEO during the Consensus Hong Kong event.

Final Thoughts

As the cryptocurrency market experiences a period of adjustment, traders are encouraged to stay updated on macroeconomic trends, regulatory changes, and emerging technologies within the sector. The landscape is continually evolving, and adaptability will be key to navigating future developments.