By James Van Straten (All times ET unless indicated otherwise)

Bitcoin’s Remarkable Rise

Despite the recent surge in U.S. consumer and producer price inflation reports, Bitcoin (BTC) has managed to break through the $97,000 mark. This upward trajectory comes as a surprise to many, as one would typically expect riskier investments like cryptocurrencies to slow down when inflation rates are higher, and the prospect of Federal Reserve rate cuts diminishes.

The unexpected resilience of Bitcoin could be attributed to signs suggesting a potential easing of inflation in the coming months. Andre Dragosch, the head of European research at Bitwise, highlights that the Truflation U.S. Inflation Index currently sits at 2.06%, indicating a possible decline in inflation rates.

The Federal Reserve’s Dilemma

Dragosch also points out the Federal Reserve’s cautious approach, driven by the lessons learned from the inflationary waves of the 1970s, which saw peaks of 6.2%, 12%, and 15%. The Fed is wary of repeating those historical mistakes, which is why they are adopting a more measured strategy and are hesitant to cut rates too aggressively.

Taking Historical Trends into Account

These factors suggest that the Bitcoin bull market may continue its upward momentum if historical patterns hold true. The 200-week moving average, which spans nearly four years, currently stands at around $44,200, still below the previous market peak of $69,000 reached in November 2021. Past trends indicate that this average has historically risen toward prior records, suggesting further price growth may be on the horizon.

Additionally, short-term holders have accumulated 1.5 million Bitcoin since September, demonstrating a sustained demand from investors who typically retain their BTC for less than 155 days. On the corporate front, Coinbase has reported strong earnings, following in Robinhood’s footsteps, and Gamestop is considering a Bitcoin investment—these developments could act as further catalysts for market growth.

Upcoming Events to Keep an Eye On

In the world of crypto, several key events are on the calendar:

Crypto Events:

— Feb. 14: Dynamic TAO (DTAO) network upgrade goes live on the Bittensor (TAO) mainnet.

— Feb. 14, 2:30 a.m.: Qtum (QTUM) hard fork network upgrade.

— Feb. 18, 10:00 a.m.: FTX Digital Markets begins reimbursing creditors.

— Feb. 21: TON becomes the exclusive blockchain infrastructure for Telegram’s Mini App ecosystem.

— Feb. 24: Ethereum developers start testing code for the Pectra network upgrade on the Holesky testnet.

Macro Events:

— Feb. 14, 8:30 a.m.: U.S. Census Bureau releases January’s Retail Sales data.

— Feb. 18, 10:20 a.m.: San Francisco Fed President Mary C. Daly speaks at the Conference for Community Bankers in Phoenix.

— Feb. 19, 2:00 p.m.: The Fed releases minutes from its Jan. 28-29 FOMC Meeting.

Earnings Reports:

— Feb. 18: CoinShares International pre-market.

— Feb. 18: Semler Scientific post-market.

— Feb. 20: Block post-market.

Token Events: Governance and Unlocks

Several DAOs are currently discussing significant governance matters:

— Aave DAO is considering using GHO as a gas token across various networks.

— Umma DAO is voting on a proposal to reduce UMA token emissions by 14%.

— Aavegotchi DAO is exploring migration to Base for better ecosystem support.

— Arbitrum DAO is discussing an upgrade to ArbOS 40, which will support Ethereum’s Pectra upgrade.

Unlock events include:

— Feb. 14: Starknet to unlock 2.48% of circulating supply worth $15.19 million.

— Feb. 15: Sei to unlock 1.25% worth $13.46 million.

— Feb. 16: Arbitrum to unlock 2.13% worth $46.2 million.

— Feb. 21: Fast Token to unlock 4.66% worth $78.8 million.

Market Movements and Trends

As of the latest update, here are the recent market movements:

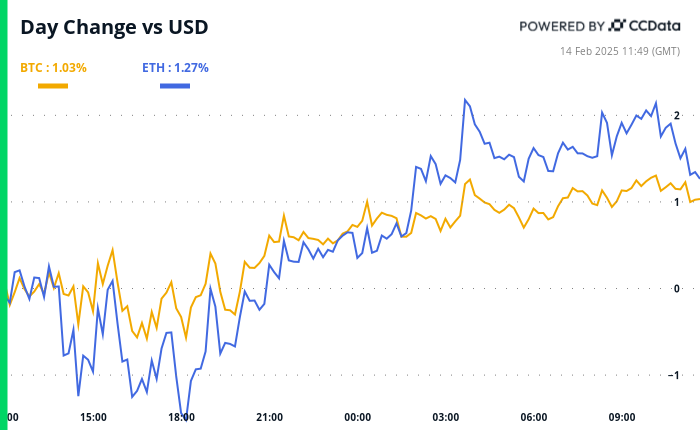

— Bitcoin (BTC) is up 0.57%, trading at $97,093.36.

— Ethereum (ETH) has risen by 1.39%, now at $2,706.09.

— The CoinDesk 20 index has increased by 3.70%, reaching 3,324.03.

In terms of key statistics:

— BTC Dominance: 60.58%

— Ethereum to Bitcoin ratio: 0.02783

— Hashrate: 818 EH/s

Technical Analysis Insights

XRP has recently bounced off the Ichimoku cloud support, keeping the broader bullish outlook intact. If prices continue to climb and break through the descending trendline resistance, there could be a move toward record highs. However, any potential drop below the cloud may indicate a bearish trend change.

Crypto Equities Update

Here’s a snapshot of some notable crypto equities:

— MicroStrategy (MSTR): Closed at $324.92, currently up 0.6% in pre-market.

— Coinbase Global (COIN): Closed at $298.11, down 1% at $295.12.

— Riot Platforms (RIOT): Closed at $12.23, slightly up at $12.24 in pre-market.

ETF Flows and Market Sentiment

In terms of ETF flows:

— Daily net flow for Spot BTC ETFs: -$156.8 million.

— Cumulative net flows stand at $40.05 billion.

— Total BTC holdings are approximately 1.171 million.

Chart of the Day

The chart illustrates the yields on U.S. 10-year and 2-year Treasury notes. Notably, the 10-year yield has decreased by 27 basis points over the past four weeks, while the 2-year yield has dropped 10 basis points. This «bull flattening» of the Treasury yield curve is viewed positively for risk assets, according to some analysts.

While You Were Sleeping

Recent developments include:

— Bitcoin’s bull market appears to be far from over, with historical trends suggesting potential for further growth.

— China’s Gaorong Ventures invested $30 million in HashKey Group, a Hong Kong-based crypto exchange operator.

— Japanese energy firm Remixpoint has increased its crypto holdings significantly, accumulating over 125 BTC.

In conclusion, the current landscape indicates a dynamic and evolving crypto market, with Bitcoin demonstrating resilience despite inflationary pressures and several significant events on the horizon.