By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin Bounces Back

The cryptocurrency market is displaying signs of stabilization as Bitcoin rebounds to $102,000, buoyed by encouraging futures indicators linked to the Nasdaq. Among the major cryptocurrencies, XRP is leading the charge with an impressive 11% increase, followed closely by SOL, which has risen by 7%. After a tough day on Monday, AI tokens are also showing signs of recovery, with gains of up to 4%.

Market Sentiment and DeepSeek Controversy

The positive risk sentiment in the market appears to be influenced by skepticism surrounding the claims made by Chinese tech startup DeepSeek. The company asserts that it spent merely $6 million to develop an AI competitor to ChatGPT. However, critics argue that this figure does not account for prior research and development expenses related to algorithms, architectures, and data. The situation is further complicated by the Jevons Paradox, which suggests that enhancements in efficiency often result in increased consumption rather than diminished usage, potentially leading to overall growth in the sector.

This is promising for Bitcoin and the broader cryptocurrency landscape, particularly as it aligns with the narrative of U.S. exceptionalism. President Trump’s crypto-friendly policies, including plans to establish a strategic digital asset reserve, also play a pivotal role in shaping market sentiment.

Legislative Developments in Arizona

In a significant move, Arizona lawmakers have passed a bill that allows government entities and public funds to invest up to 10% of their capital in Bitcoin and other digital assets. This legislative change is expected to further bolster the positive outlook for cryptocurrencies.

Market Outlook: Bullish Indicators

The overall market outlook remains bullish, with on-chain data indicating the capitulation of weaker investors and continued accumulation by large players. According to data from CryptoQuant, the percentage of investors holding at least 1,000 BTC and who purchased coins in the last 155 days has surged from 43% to 60%. This trend reflects the growing presence of large investors amidst an optimistic market sentiment, as noted by Alex Kuptsikevich, Chief Market Analyst at FxPro.

Looking ahead, QCP Capital anticipates that this week will be crucial in assessing Bitcoin’s correlation with equities, especially given the favorable regulatory environment that could provide support.

Key Upcoming Events to Watch

Crypto Events:

— **Jan. 28, 1:00 p.m.**: Hedera (HBAR) network upgrade (v0.57.5).

— **Jan. 29**: Cardano’s Plomin hard fork network upgrade.

— **Jan. 29**: Ice Open Network (ION) mainnet launch.

— **Feb. 2, 8:00 p.m.**: Core blockchain Athena hard fork network upgrade (v1.0.14).

— **Feb. 4**: MicroStrategy (MSTR) Q4, FY 2024 earnings.

— **Feb. 4**: Pepecoin (PEPE) halving at block 400,000, reducing rewards to 31,250 PEPE.

— **Feb. 5, 3:00 p.m.**: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

— **Feb. 6, 8:00 a.m.**: Shentu Chain network upgrade (v2.14.0).

— **Feb. 12**: Hut 8 Corp. (HUT) Q4 2024 earnings.

— **Feb. 15**: Qtum (QTUM) hard fork network upgrade at block 4,590,000.

— **Feb. 18 (after market close)**: Semler Scientific (SMLR) Q4 2024 earnings.

— **Feb. 20**: Coinbase Global (COIN) Q4 2024 earnings.

Macro Events:

— **Jan. 28, 8:30 a.m.**: U.S. Census Bureau releases December Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders.

— **Jan. 28, 1:00 p.m.**: The Fed releases December’s H.6 (Money Stock Measures) report.

— **Jan. 29, 12:00 a.m.**: Japan’s Cabinet Office releases January’s Consumer Confidence Survey.

— **Jan. 29, 4:00 a.m.**: European Central Bank (ECB) releases Monetary Developments in the Euro Area for December.

— **Jan. 29, 8:45 a.m.**: Bank of Canada (BoC) releases quarterly Monetary Policy Report.

— **Jan. 29, 9:45 a.m.**: BoC interest-rate decision announcement.

— **Jan. 29, 2:00 p.m.**: Federal Open Market Committee (FOMC) announces interest-rate decision.

Token Events and Governance Votes

Governance Votes:

— Morpho DAO is voting to reduce MORPHO rewards by 30% across all assets and networks.

— Sky DAO is considering lowering the WBTC liquidation threshold from 55% to 50% on SparkLend Ethereum.

— Yearn DAO is deliberating on funding and endorsing Bearn, a new subDAO focused on product development on Berachain.

Unlocks:

— **Jan. 28**: Tribal Token (TRIBL) will unlock 14% of its circulating supply worth $60 million.

— **Jan. 31**: Optimism (OP) will unlock 2.32% of its circulating supply worth $52.9 million.

— **Jan. 31**: Jupiter (JUP) will unlock 41.5% of its circulating supply worth $626 million.

— **Feb. 1**: Sui (SUI) will unlock about 2.13% of its circulating supply worth $226 million.

Token Listings:

— **Jan. 28**: Pudgy Penguins (PENGU) and Magic Eden (ME) listed on Kraken.

— **Jan. 29**: Cronos (CRO), Movement (MOVE), and Usual (USUAL) also to be listed on Kraken.

Upcoming Conferences

— **Jan. 29-31**: Crypto Peaks 2025 in Palisades, California.

— **Jan. 30, 12:30 p.m. to 5:00 p.m.**: International DeFi Day 2025 (online).

— **Jan. 30-31**: Ethereum Zurich 2025.

— **Jan. 30-31**: Plan B Forum in San Salvador, El Salvador.

— **Jan. 30 to Feb. 1**: Crypto Gathering 2025 in Miami Beach, Florida.

— **Jan. 30-Feb. 1**: CryptoXR 2025 in Auxerre, France.

— **Jan. 30-Feb. 2**: Oasis Onchain 2025 in Nassau, Bahamas.

— **Jan. 30-Feb. 4**: The Satoshi Roundtable in Dubai.

— **Feb. 1-28**: Mammathon global hackathon for Celestia (online).

— **Feb. 3**: Digital Assets Forum in London.

— **Feb. 5-6**: The 14th Global Blockchain Congress in Dubai.

— **Feb. 6**: Ondo Summit 2025 in New York.

— **Feb. 7**: Solana APEX in Mexico City.

— **Feb. 13-14**: The 4th Edition of NFT Paris.

— **Feb. 18-20**: CoinDesk’s Consensus in Hong Kong.

— **Feb. 19**: Sui Connect in Hong Kong.

— **Feb. 23-March 2**: ETHDenver 2025 in Denver, Colorado.

— **Feb. 25**: HederaCon 2025 in Denver.

Market Highlights and Trends

AI-focused Venice AI (VVV) achieved a remarkable $1 billion market capitalization on Monday, attracting attention for its offer of private, uncensored AI inference access without per-request fees. The token, which was listed on Coinbase—the only asset to be launched on the exchange on its debut day—gained traction rapidly. Users can stake VVV tokens to access API services from AI leader DeepSeek, alongside ongoing rewards from token emissions.

In the derivatives market, CME’s Bitcoin and Ether futures experienced a notable decline in open interest on Monday as traders sought to mitigate risks following a sharp downturn in Nvidia and other Nasdaq stocks. Perpetual funding rates for major cryptocurrencies have stabilized within an annualized range of 5%-10%, although Bitcoin funding rates briefly dipped below zero earlier in the week.

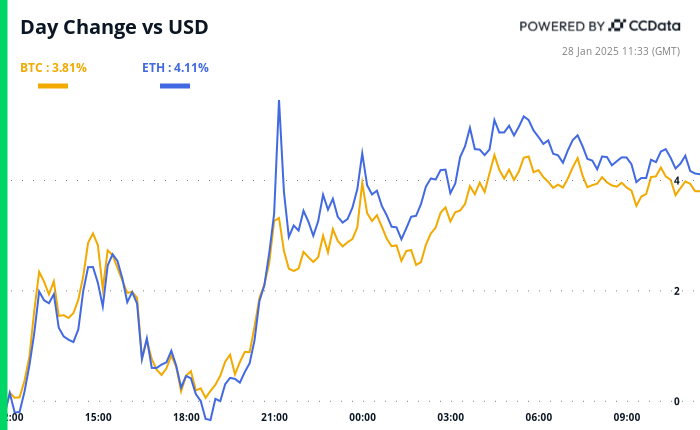

Market movements reflect a slight upward trend:

— **BTC** is up 1.32% from 4 p.m. ET on Monday to $98,784.45 (24hrs: +4.07%).

— **ETH** has increased by 1.62% to $3,050.20 (24hrs: +4.52%).

— The CoinDesk 20 index is up 3.2% to 3,536.28 (24hrs: +6.73%).

Bitcoin Statistics

— **BTC Dominance**: 59.16 (0.15% change)

— **Ethereum to Bitcoin Ratio**: 0.031 (-0.32% change)

— **Hashrate (7-day moving average)**: 767 EH/s

— **Hashprice (spot)**: $58.7

— **Total Fees**: 6.13 BTC / $616,619

— **CME Futures Open Interest**: 170,240 BTC

— **BTC Priced in Gold**: 37.6 oz

— **BTC vs Gold Market Cap**: 10.68%

Technical Insights

Ethreum’s performance showed a candle formation with a long tail on Monday, indicating potential exhaustion of bearish momentum at intraday lows—a common precursor to a trend reversal. However, current prices remain confined within a descending channel, suggesting a continued bearish outlook.

Crypto Equities Performance

— **MicroStrategy (MSTR)**: Closed at $347.92 (-1.63%), down 0.36% to $346.66 in pre-market.

— **Coinbase Global (COIN)**: Closed at $277.99 (-6.71%), slightly up to $280.11 in pre-market.

— **Galaxy Digital Holdings (GLXY)**: Closed at C$27.36 (-15.87%).

— **MARA Holdings (MARA)**: Closed at $18.28 (-8.53%), rising to $18.40 in pre-market.

— **Riot Platforms (RIOT)**: Closed at $11.45 (-15.44%), down to $12.61 in pre-market.

— **Core Scientific (CORZ)**: Closed at $11.28 (-29.41%), with a slight increase to $11.53 in pre-market.

— **CleanSpark (CLSK)**: Closed at $10.31 (-10.62%), edging up to $10.43 in pre-market.

— **CoinShares Valkyrie Bitcoin Miners ETF (WGMI)**: Closed at $20.78 (-20.75%), down to $21.61 in pre-market.

— **Semler Scientific (SMLR)**: Closed at $50.43 (-9.07%).

— **Exodus Movement (EXOD)**: Closed at $74 (+20.82%), stable in pre-market.

ETF Flows Overview

— **Spot BTC ETFs**:

— Daily net flow: -$457.6 million

— Cumulative net flows: $39.49 billion

— Total BTC holdings: approximately 1.157 million.

— **Spot ETH ETFs**:

— Daily net flow: -$136.2 million

— Cumulative net flows: $2.67 billion

— Total ETH holdings: approximately 3.59 million.

Source: Farside Investors

Overnight Developments

— **KuCoin’s Legal Troubles**: KuCoin has agreed to pay nearly $300 million after pleading guilty to operating an unlicensed money-transmitting business.

— **Tuttle Capital’s ETF Proposals**: Tuttle Capital Management filed proposals for the first-ever leveraged ETFs tracking TRUMP and MELANIA memecoins.

— **Jim Cramer’s Bitcoin Advice**: On “Mad Money,” Jim Cramer recommended owning Bitcoin while advising against investing in MicroStrategy.

— **Ripple’s CEO on Digital Assets**: Brad Garlinghouse advocates for a diversified U.S. crypto reserve that includes multiple tokens, criticizing BTC maximalism.

— **Bank of Japan Predictions**: Former BOJ board member Makoto Sakurai forecasts interest rate hikes to 1.5% by mid-2025.

— **Dollar Strengthening**: The dollar rose against major currencies amid renewed tariff threats from President Trump and Treasury Secretary Scott Bessent.

— **OpenAI’s Response to Competition**: CEO Sam Altman has promised enhanced models in response to competition posed by DeepSeek’s AI.

Insights from the Ether

The cryptocurrency landscape is continuously evolving, with major developments and trends shaping the market. Stay informed and engaged as we navigate through these dynamic changes.

—

This revised article maintains the core information while enhancing readability and providing a structured overview of the crypto market updates.