By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin and Ether Show Resilience Post-Bybit Hack

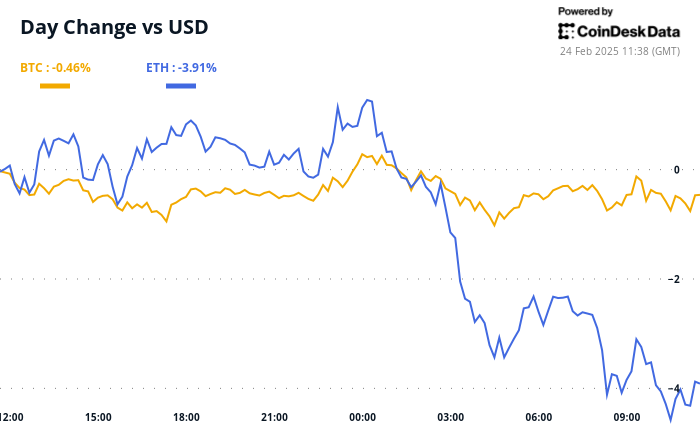

In the wake of the recent $1.5 billion hack on Bybit, one of the leading cryptocurrency exchanges, Bitcoin and Ether, the two most prominent digital currencies by market capitalization, have demonstrated remarkable resilience. Two days after the incident, both cryptocurrencies are maintaining their recent trading ranges without significant fluctuations.

Positive perpetual funding rates for Bitcoin and Ether indicate a favorable sentiment among traders, favoring long positions that anticipate price increases. Furthermore, analysis of Bitcoin options trading on Deribit reveals a bullish trend for call options across various time frames. In contrast, Ether options present a bearish outlook extending into March, although this downside sentiment predates the hack.

Market Stability Signals Maturity

According to Volmex Finance, the 30-day implied volatility index for Bitcoin has decreased to an annualized 48.45%, the lowest level since July, suggesting a sense of stability in the market. Meanwhile, Ether’s implied volatility has corrected after a minor spike over the weekend, settling between 67% and 70%.

This calmness in the market is interpreted as a sign of maturity by QCP Capital. They assert that the current price dynamics reflect the evolution of the cryptocurrency landscape since the FTX collapse in 2022. The firm notes substantial improvements across various domains of the crypto industry, including custodial security, corporate governance, and transparency, as a response to past crises.

Bybit’s Response to the Hack

The crypto community has expressed a sense of reassurance regarding Bybit’s effective management of over $6 billion in withdrawals following the hack. Additionally, the exchange has successfully replenished its ETH reserves, further stabilizing the market.

Traders Set Their Sights on Solana’s SOL ETF

Mena Theodorou, co-founder of crypto exchange Coinstash, highlights a significant development on the horizon: Franklin Templeton, a leading global asset management firm, has submitted a proposal for a spot SOL ETF to the SEC. Additionally, on March 1, 11.2 million SOL tokens (representing 2.3% of the total supply) from the FTX estate are set to be unlocked, potentially leading to market volatility. This upcoming event has already sparked increased trading volume in SOL put options on Deribit.

In a related note, President Donald Trump’s recent decision to audit gold reserves at Fort Knox has caught the attention of the crypto community. Theodorou comments that should the gold supply be lower than expected, it could bolster Bitcoin’s position as «digital gold» and a potentially superior reserve asset.

Macro Environment Calls for Caution

In traditional markets, the Japanese yen is gaining against the U.S. dollar, as well as against growth-sensitive currencies like the Australian dollar. This trend calls for caution among risk asset bulls as they navigate the current economic landscape.

What to Watch in Crypto and Macro Events

Crypto Events:

— February 24, 11:00 a.m.: Bugis network upgrade on Enjin Relaychain mainnet.

— February 24: Testing of Ethereum’s Pecta upgrade on the Holesky testnet begins at epoch 115968.

— February 25, 9:00 a.m.: Ethereum Foundation research team AMA on Reddit.

— February 25: Pascal hard fork network upgrade on the BNB Smart Chain (BSC) testnet.

— February 25: Launch of Reactive Network mainnet and the initial creation of the REACT token.

Macro Events:

— February 24, 8:00 p.m.: Bank of Korea’s Monetary Policy Committee announces interest rate decision (Est. 2.75% vs. Prev. 3%).

— February 25, 10:00 a.m.: Conference Board releases February’s Consumer Confidence Index report (Est. 102.1 vs. Prev. 104.1).

— February 25, 1:00 p.m.: Richmond Fed President Tom Barkin discusses “Inflation Then and Now.”

— February 25, 7:30 p.m.: Australian Bureau of Statistics releases January’s Monthly Consumer Price Index Indicator report (Est. 2.5% vs. Prev. 2.5%).

Earnings Reports:

— February 24: Riot Platforms (RIOT), post-market, estimated earnings -$0.18.

— February 25: Bitdeer Technologies Group (BTDR), pre-market, estimated earnings -$0.17.

— February 25: Cipher Mining (CIFR), pre-market, estimated earnings -$0.09.

— February 26: MARA Holdings (MARA), post-market, estimated earnings -$0.13.

— February 26: NVIDIA (NVDA), post-market.

Token Events and Governance Changes

Governance Votes & Discussions:

— Sky DAO is voting on changes to reduce the Smart Burn Engine’s protocol-owned liquidity to $15 million and enable immediate buybacks.

— Ampleforth DAO is considering reducing the Flash Mint fee to 0.5% and the Flash Redeem fee to 5% to enhance system adaptability.

— DYdX DAO is discussing the establishment of a buyback program, allocating 25% of the protocol’s net revenue for this purpose.

Unlocks:

— February 28: Optimism (OP) will unlock 2.32% of circulating supply, valued at $35.43 million.

— March 1: DYdX will unlock 1.14% of circulating supply, valued at $6.24 million.

— March 1: ZetaChain (ZETA) will unlock 6.48% of circulating supply, valued at $13.7 million.

— March 1: Sui (SUI) will unlock 0.74% of circulating supply, valued at $81.07 million.

— March 7: Kaspa (KAS) will unlock 0.63% of circulating supply, valued at $15.55 million.

— March 12: Aptos (APT) will unlock 1.93% of circulating supply, valued at $69.89 million.

Token Listings:

— February 25: Zoo (ZOO) will be listed on KuCoin.

— February 26: Moonwell (WELL) will be listed on Kraken.

— February 27: Venice (VVV) will be listed on Kraken.

— February 28: Worldcoin (WLD) will be listed on Kraken.

Conferences on the Horizon

Mark your calendars for upcoming crypto conferences:

— CoinDesk’s Consensus: May 14-16 in Toronto. Use code DAYBOOK for a 15% discount on passes.

— ETHDenver: Day 2 of 8.

— RWA London Summit: February 24, 2025.

— HederaCon: February 25, 2025, in Denver.

— Crypto Expo Europe: March 2-3 in Bucharest, Romania.

— Bitcoin Alive: March 8 in Sydney, Australia.

Derivatives Market Insights

Recent developments in derivatives positioning show that SOL put options expiring this Friday on Deribit are trading at a premium of 7 volatility points compared to calls, indicating significant downside fears. Ether options continue to express concerns about downside risks until the end of March, with subsequent expiries reflecting a more bullish positioning. Conversely, Bitcoin options present a bullish outlook across various time frames.

Funding rates in perpetual futures related to the OM token remain negative, indicating traders are hedging against potential bearish movements as the spot price reaches record highs.

Market Movements and Price Updates

As of the latest updates:

— Bitcoin (BTC) is up 0.7% from 4 p.m. ET Friday, trading at $95,581.78 (24-hour change: -0.6%).

— Ethereum (ETH) is up 1.91% at $2,679.37 (24-hour change: -4.25%).

— The CoinDesk 20 index is up 1.18% at 3,089.09 (24-hour change: -3.52%).

— Bitcoin funding rates on Binance are at 0.0069% (7.51% annualized).

— The U.S. Dollar Index (DXY) remains unchanged at 106.6.

Bitcoin Statistics at a Glance

— BTC Dominance: 61.65% (24-hour change: 1.3%).

— Ethereum to Bitcoin ratio: 0.02801 (-4.4%).

— Hashrate (seven-day moving average): 789 EH/s.

— Hashprice (spot): $56.53.

— Total Fees: 5.65 BTC / $540,507.

— CME Futures Open Interest: 169,620 BTC.

— BTC priced in gold: 32.3 oz.

— BTC vs gold market cap: 9.17%.

Technical Analysis of SOL

The daily chart for Solana (SOL) indicates that the cryptocurrency has recently fallen below its critical 200-day simple moving average. Additionally, it has confirmed a double top breakdown by moving below a significant horizontal support line. This bearish technical setup suggests the potential for continued losses towards $120, a price point that served as a support level last year. Conversely, a move above the recent lower high of $209 would invalidate the bearish outlook.

Crypto Equities Performance

— MicroStrategy (MSTR): Closed Friday at $299.69 (-7.48%), up 1.21% in pre-market trading at $303.31.

— Coinbase Global (COIN): Closed at $235.38 (-8.27%), up 2.02% in pre-market at $240.20.

— Galaxy Digital Holdings (GLXY): Closed at C$22.76 (-11.27%).

— MARA Holdings (MARA): Closed at $14.66 (-8.09%), up 0.41% in pre-market at $14.72.

— Riot Platforms (RIOT): Closed at $10.46 (-9.83%), up 2.77% in pre-market at $10.75.

— Core Scientific (CORZ): Closed at $10.80 (-8.78%), unchanged in pre-market.

— CleanSpark (CLSK): Closed at $9.24 (-8.15%), up 0.97% in pre-market at $9.34.

— CoinShares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $20.52 (-8.76%).

— Semler Scientific (SMLR): Closed at $47.74 (-8.61%), up 0.65% in pre-market at $48.05.

— Exodus Movement (EXOD): Closed at $47.81 (+0.02%).

ETF Flows Overview

Spot BTC ETFs:

— Daily net flow: -$69.2 million.

— Cumulative net flows: $39.57 billion.

— Total BTC holdings: ~1.167 million.

Spot ETH ETFs:

— Daily net flow: -$8.9 million.

— Cumulative net flows: $3.15 billion.

— Total ETH holdings: ~3.808 million.

Overnight Flows and Market Dynamics

Recent analysis indicates a notable decrease in daily transactions and cumulative trading volumes on Solana’s decentralized exchanges since the introduction of the TRUMP memecoin a month ago.

While You Were Sleeping

— Bybit successfully replenished its ETH reserves, closing a significant gap of $1.4 billion following the recent hack.

— Engagement in SOL put options surged on Deribit amid concerns over SOL’s declining price and the upcoming token unlock on March 1.

— Economic indicators suggest the European Central Bank may need to lower its key rate to stimulate economic growth if inflation cools.

— Traders are positioning themselves for potential volatility ahead of pivotal Nvidia earnings, reflecting caution despite a recent S&P 500 rally.

In the Ether

As the crypto landscape continues to evolve, traders and investors alike remain vigilant, navigating the complexities of market movements, regulatory developments, and technological advancements in this dynamic financial ecosystem.