By Omkar Godbole (All times ET unless indicated otherwise)

Cardano’s Momentum and Bitcoin’s Stagnation

Cardano’s ADA is experiencing a notable increase in trading value, driven by Grayscale’s recent application for a spot ETF. In contrast, Bitcoin (BTC) remains trapped within a narrow trading range, reflecting a generally lackluster cryptocurrency market as we anticipate Federal Reserve Chair Jerome Powell’s testimony to Congress.

Powell’s Upcoming Testimony

Later today, Powell will deliver his semi-annual update on monetary policy before the Senate, with a repeat performance scheduled for the House of Representatives on Wednesday. Market participants are skeptical that his remarks will spark a significant rally for BTC. The prevailing sentiment is that Powell will maintain his data-driven approach, emphasizing that the Federal Reserve is not in a hurry to implement interest rate cuts and is committed to monitoring inflation trends closely.

Recent data shared by Bloomberg’s Lisa Abramowicz indicates that market-implied inflation rates for the next two to five years have surged to their highest levels since early 2023. Furthermore, President Donald Trump’s tariffs may contribute to inflationary pressures. According to the CME’s FedWatch tool, traders currently anticipate only 50 basis points in cuts by the end of next year, which is significantly lower than the forecasts provided by the Federal Open Market Committee (FOMC) in December.

Potential Market Catalysts

There is a silver lining, however. If the Consumer Price Index (CPI) data released tomorrow shows weaker-than-expected results, it could lead to some upside volatility in the market.

Japanese Investment in Bitcoin

In other news, Japanese mobile game developer Gumi has announced plans to purchase Bitcoin valued at 1 billion yen (approximately $6.6 million), following the example set by Tokyo-listed Metaplanet. Metaplanet’s foray into BTC last year resulted in an astonishing 4,800% share price increase over a 12-month period.

Ethereum Ecosystem Discussions

Social media platforms are abuzz with discussions surrounding the imbalance within Ethereum’s ecosystem. Layer-2 scaling solutions are capturing a substantial portion of the revenue generated, while contributing only a small fraction back to Ethereum’s foundational layer. Meanwhile, Solana continues to outperform Ethereum and other smart contract blockchains in terms of decentralized exchange trading volumes and revenue.

Market Snapshot and What to Watch

In traditional markets, gold is taking a breather from its bullish run, while copper, often viewed as a barometer of global economic health, has experienced a decline that ended a six-day winning streak.

For cryptocurrency enthusiasts, several important events are on the horizon:

— **Feb. 13**: Kraken begins the gradual delisting of USDT, PYUSD, EURT, TUSD, and UST stablecoins for EEA clients, concluding on March 31.

— **Feb. 13**: Launch of Story (IP) mainnet.

— **Feb. 14**: Upgrade of Dynamic TAO (DTAO) network on the Bittensor (TAO) mainnet.

— **Feb. 14, 2:30 a.m. (Estimate)**: Hard fork network upgrade for Qtum (QTUM).

— **Feb. 18, 10:00 a.m.**: FTX Digital Markets begins reimbursing creditors.

Additionally, macroeconomic events to keep an eye on include:

— **Feb. 11, 10:00 a.m.**: Powell’s semi-annual report to the U.S. Senate Committee.

— **Feb. 12, 8:30 a.m.**: Release of January’s Consumer Price Index (CPI) report.

Token Events and Governance Discussions

In governance discussions, Aave DAO is considering recognizing HyperLend as a friendly fork on the Hyperliquid EVM chain and the deployment of Aave v3 on Kraken’s layer-2 rollup network. Meanwhile, Sky DAO is contemplating onboarding Arbitrum One to the Spark Liquidity layer and increasing the PSM2 rate limits on Base.

Morpho DAO is debating a 25% reduction in MORPHO rewards on Ethereum and Base after a previous reduction took effect on January 30. DYdX DAO is voting on the dYdX Treasury subDAO taking control of the stDYDX within the Community Treasury.

Market Movements and Technical Analysis

As of the latest update:

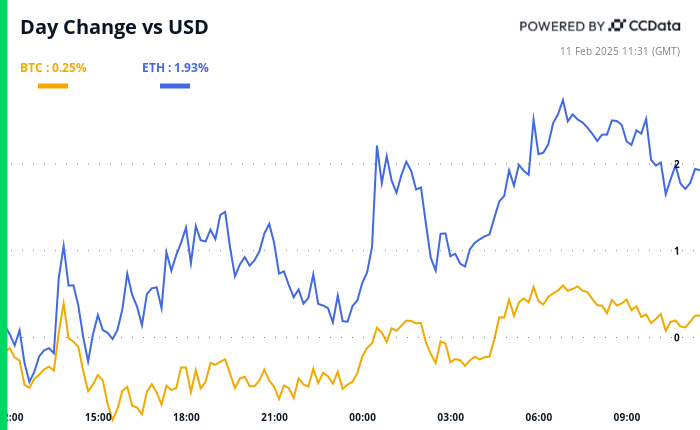

— **BTC**: Up 0.62% from 4 p.m. ET Monday to $97,989.64 (24hrs: +0.27%).

— **ETH**: Up 0.53% at $2,702.45 (24hrs: +2.07%).

— **CoinDesk 20**: Up 1.79% to 3,269.36 (24hrs: +1.77%).

The BTC funding rate on Binance is currently 0.01% (10.95% annualized). The monthly chart for BTC illustrates how trendlines drawn from major price points act as support levels, with the downside consistently capped around $90,000 over the past two months.

Crypto Equities Overview

In the equities market, notable movements include:

— **MicroStrategy (MSTR)**: Closed at $334.62 (+2.16%).

— **Coinbase Global (COIN)**: Closed at $280.22 (+2.09%).

— **Galaxy Digital Holdings (GLXY)**: Closed at C$27.24 (+1.3%).

Conclusion

As the markets evolve, traders and investors should remain attentive to upcoming events that could impact both cryptocurrency prices and broader economic conditions. With Powell’s testimony on the horizon and various token events scheduled, the coming days promise to be significant for the crypto landscape.