By Francisco Rodrigues (All Times ET)

Current Market Overview

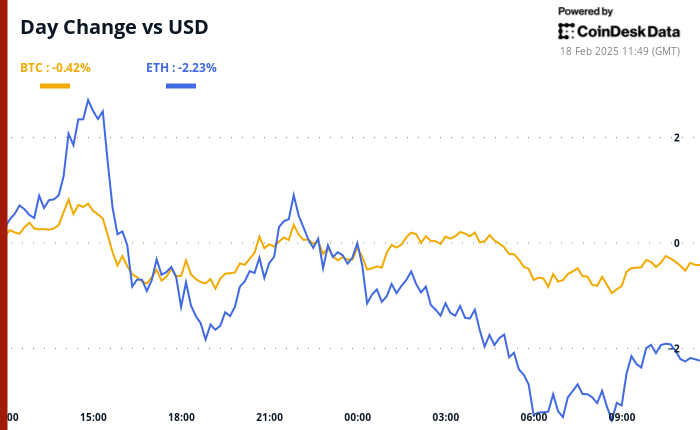

Bitcoin (BTC) remains relatively stable, showing a slight decrease of 0.7% over the last 24 hours. However, the broader cryptocurrency market is experiencing a bearish sentiment, largely influenced by the fallout from the Libra token controversy. This situation has sparked allegations of fraud and led to demands for the impeachment of Argentina’s President, Javier Milei.

The CoinDesk 20 Index has fallen approximately 2.3% in the past day. Market movements in the near to medium term are expected to be influenced by ongoing U.S.-Russia negotiations taking place in Riyadh, which aim to address the conflict in Ukraine and work towards normalizing relations between the two nations.

FTX’s Repayment Program Commences

Adding to the market’s uncertainty is the commencement of repayments by FTX Digital Markets, the Bahamian subsidiary of the now-defunct FTX exchange. Starting today, FTX will begin reimbursing creditors in a total repayment program estimated at around $16 billion.

This liquidity injection will be distributed in the form of stablecoins, beginning with creditors holding claims under $50,000, who can expect to receive approximately 119% of their claim value, alongside 9% annual interest accrued since November 2022.

The impact of these repayments on the market remains uncertain. While some analysts indicate that the amounts being reimbursed may be too small to significantly shift market dynamics, others suggest that FTX’s previous investments in the Solana ecosystem may lead to some of these funds being reinvested there.

Shift in Investor Attention Towards Ethereum

In recent developments, investors are increasingly focusing on Ether. U.S.-listed spot ETFs that provide exposure to Ethereum have seen net inflows totaling $393 million this month, contrasting with a net outflow of $376 million for spot Bitcoin ETFs.

These inflows coincide with the upcoming Pectra upgrade for Ethereum, which is entering its testing phase on the Holesky testnet. This upgrade promises enhancements in scalability and security while allowing users to pay gas fees with tokens other than Ether.

Investor Sentiment and Market Outlook

Amid trade-war threats, diminished expectations for interest rate cuts, and persistent inflation surprises, individual investors are exhibiting a bearish outlook. A survey conducted by the American Association of Individual Investors revealed that bearish sentiment is at its highest level in two years, according to the Wall Street Journal.

Interestingly, this pervasive pessimism might serve as a contrarian indicator. Institutional investors are showing reduced risk appetite this month, reflecting concerns over potential trade war impacts and decreasing chances of a Federal Reserve rate cut.

What to Watch: Upcoming Crypto and Macro Events

Crypto Events:

— February 18, 10:00 a.m.: FTX Digital Markets begins creditor reimbursements.

— February 19: Monad, a high-performance blockchain, launches its public testnet.

— February 19, 11:00 a.m.: Live stream of the first official State of Sei (SEI) event.

— February 19, 1:00 p.m.: Hedera (HBAR) mainnet upgrade to v0.58.

— February 21: TON (The Open Network) becomes the exclusive blockchain for Telegram’s Mini App ecosystem.

— February 24: Testing of Ethereum’s Pectra upgrade begins on the Holesky testnet.

Macro Events:

— February 18, 10:20 a.m.: San Francisco Fed President Mary C. Daly delivers a speech in Phoenix.

— February 18, 1:00 p.m.: Fed Vice Chair Michael S. Barr presents on «Artificial Intelligence in the Economy and Financial Stability» in New York.

— February 19, 2:00 p.m.: Release of the minutes from the January 28-29 FOMC meeting.

Earnings Reports:

— February 18: CoinShares International (CS), pre-market.

— February 18: Semler Scientific (SMLR), post-market.

— February 20: Block (XYZ), post-market, $0.88.

— February 24: Riot Platforms (RIOT), post-market, $-0.18.

Token Events and Governance Discussions

Governance Updates:

— Compound DAO is exploring the evolution of Compound Sandbox into Compound V4 to enhance governance and market dynamics.

— Aave DAO is considering expanding AAVE governance token integration by adding collateral options to Base.

— Uniswap DAO is discussing funding liquidity incentives for Uniswap V4 on the Unichain network.

Token Unlocks:

— February 21: Fast Token (FTN) will unlock 4.66% of its circulating supply, equivalent to $78.6 million.

— February 28: Optimism (OP) will unlock 1.92% of its circulating supply, valued at $34.23 million.

Token Launches:

— February 18: Ethena (ENA) will be listed on Arkham.

— February 18: Ronin (RON) will be listed on KuCoin.

Upcoming Conferences and Networking Opportunities

CoinDesk’s Consensus will be held in Hong Kong from February 18-20 and in Toronto from May 14-16. For attendees, using the code DAYBOOK provides a 15% discount on passes.

Additional Events:

— February 23-March 2: ETHDenver 2025 in Denver.

— February 24: RWA London Summit 2025.

— February 25: HederaCon 2025 in Denver.

— March 2-3: Crypto Expo Europe in Bucharest, Romania.

— March 8: Bitcoin Alive in Sydney, Australia.

Token News and Market Analysis

In recent news, supporters of Donald Trump are set to receive around $50 worth of official TRUMP tokens upon purchasing merchandise from associated websites. This token, which was launched shortly before Trump’s presidency, has seen a decline of over 70% in value since then.

On the Solana network, the decentralized exchange Jupiter has initiated a plan to accumulate USDC by using 50% of collected protocol fees to buy back JUP tokens, although buybacks have not yet commenced. The JUP token’s price has dropped by more than 12% over the past 24 hours due to its connection to the LIBRA cryptocurrency controversy.

Market Positioning and Trends

The price of SOL may continue to decline as perpetual futures open interest has increased by 5% in the past 24 hours, coupled with a negative cumulative volume delta (CVD), indicating net selling pressure.

The CVD for most major cryptocurrencies is negative, reflecting a bearish sentiment in the market. Furthermore, BTC and ETH short-term puts are currently more expensive than calls on Deribit, suggesting a bullish outlook post-February expiry. Recent block flows have included an April expiry bitcoin bull put spread, while ether bull call spreads have also been observed.

Current Market Movements

As of the latest updates:

— BTC is down 0.69% from 4 p.m. ET Monday, trading at $95,802.76 (24hrs: -0.57%).

— ETH has decreased by 2.88%, now priced at $2,698.31 (24hrs: -1.89%).

— The CoinDesk 20 Index is down 2.23% to 3,161.95 (24hrs: -3.03%).

Additional Market Indicators:

— Ether CESR Composite Staking Rate has risen by 27 basis points to 3.18%.

— BTC funding rate on Binance is at 0.0078% (8.5541% annualized).

— DXY has increased by 0.36% to 106.94.

— Gold is up 0.97% at $2,922.9/oz.

— Silver has risen by 0.70% to $32.99/oz.

Bitcoin Statistics

— BTC Dominance: 61.17 (0.85%).

— Ethereum to Bitcoin ratio: 0.02813 (-1.71%).

— Hashrate (seven-day moving average): 790 EH/s.

— Hashprice (spot): $53.47.

— Total fees generated: 6.93 BTC / $663,706.

— CME Futures Open Interest: 174,200 BTC.

— BTC priced in gold: 32.8 oz.

— BTC vs gold market cap: 9.31%.

Technical Analysis Insights

Recent chart analysis indicates a potential bullish double-bottom pattern in Tether’s USDT dominance rate, which appears to have rebounded off its March 2024 low. This pattern often signals increased dominance during market-wide price corrections.

Crypto Equities Performance

— MicroStrategy (MSTR) closed Friday at $337.73 (+3.94%), down 0.6% to $335.76 in pre-market trading.

— Coinbase Global (COIN) closed at $274.31 (-7.98%).

— Galaxy Digital Holdings (GLXY) closed at C$27.65 (-2.54%).

— MARA Holdings (MARA) closed at $16.90 (-0.06%).

— Riot Platforms (RIOT) closed at $12.27 (+0.33%).

— Core Scientific (CORZ) closed at $12.51 (-0.24%).

— CleanSpark (CLSK) closed at $10.50 (-1.59%).

— CoinShares Valkyrie Bitcoin Miners ETF (WGMI) closed at $23.40 (+0.52%).

— Semler Scientific (SMLR) closed at $49.67 (+0.44%).

— Exodus Movement (EXOD) closed at $50.00 (unchanged).

ETF Flow Analysis

As of February 14, the U.S. markets were closed on February 17. The data shows:

— Spot BTC ETFs: Daily net flow of $70.6 million; cumulative net flows of $40.12 billion; total BTC holdings around 1.180 million.

— Spot ETH ETFs: Daily net flow of $11.7 million; cumulative net flows of $3.15 billion; total ETH holdings around 3.791 million.

Market Trends and Predictions

Bitcoin is currently trading within a narrow range between $91,000 and $109,000 since late November, with its two-week realized volatility dropping to 32% annually, according to data from Glassnode. Analysts suggest that a breakout from this range could be imminent, particularly as Bitcoin’s historical correlation with tech stocks, like the Nasdaq 100, indicates potential upward movement.

In conclusion, while the crypto market grapples with uncertainties stemming from the LIBRA fallout and the FTX repayment process, significant shifts in investor sentiment and upcoming technological upgrades present opportunities for potential growth. As always, staying informed and vigilant is essential in the ever-evolving landscape of cryptocurrencies.