By Omkar Godbole (All times ET unless indicated otherwise)

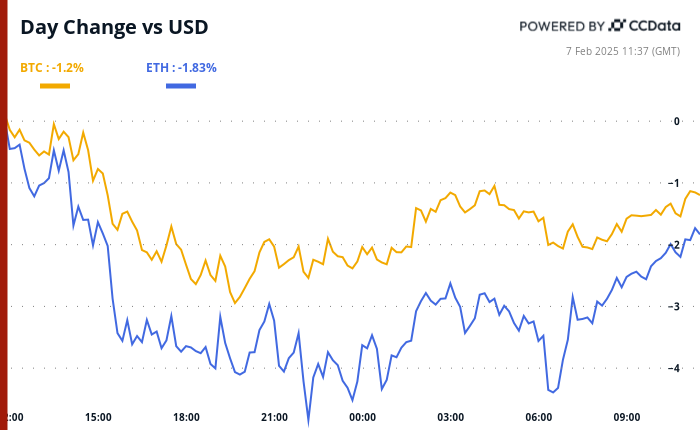

The crypto market is currently in a state of inertia, with Bitcoin (BTC) struggling to breach the $100,000 mark ahead of the anticipated U.S. jobs report. This stagnation is noteworthy, especially given that Eric Trump, the son of former President Donald Trump, publicly urged investment in Bitcoin through a post on X earlier this week.

Bitcoin’s Market Reaction to High-Profile Endorsements

Typically, endorsements from high-profile figures during a bullish market can lead to significant price surges. However, the lack of upward momentum following Trump’s endorsement suggests that the market is no longer swayed by mere rhetoric. Instead, it appears that investors are waiting for more substantive action. Earlier this week, the Trump administration hinted at evaluating the viability of a strategic Bitcoin reserve, yet this has not translated into market enthusiasm.

Investor Caution and Potential Market Moves

Another factor contributing to Bitcoin’s subdued performance could be investor caution in anticipation of the nonfarm payroll data. Should the employment figures come in lower than expected, it could lead to a breakout in Bitcoin’s price, as such news may result in a decrease in Treasury yields and a weakening dollar index.

Crypto newsletter service LondonCryptoClub advised traders to keep an eye on revisions to previous employment figures. They noted that Bloomberg Intelligence is forecasting significant downward adjustments, which could indicate that the labor market is not as robust as initially perceived. They further suggested that both the market and the Federal Reserve may be underestimating the necessary rate cuts to address potential economic shifts.

Market Volatility on the Horizon

At the time of writing, the one-day implied volatility index for Bitcoin by Volmex was recorded at an annualized 51%. This implies that Bitcoin’s price could swing by approximately $2,600 in either direction on any given day. Interestingly, some traders are purchasing put options, preparing for possible downward volatility depending on the jobs data outcome.

Key Legislative Developments

In legislative news, Utah’s “Strategic Bitcoin Reserve” bill has successfully passed the House and is now set to be reviewed by the Senate. Bloomberg ETF analyst James Seyffart reported that the U.S. SEC has recognized Grayscale’s Solana 19b-4 filing. Additionally, investment firm VanEck is projecting a price target of $500 for Solana (SOL), more than double its current value of around $180.

Stablecoin Regulation on the Horizon

Furthermore, FOX reporter Eleanor Terrett disclosed that U.S. House Financial Services Committee Chairman French Hill and Digital Assets Subcommittee Chairman Bryan Steil have introduced a draft for stablecoin regulation. This proposal includes a two-year ban on stablecoins that are solely backed by self-issued digital assets, alongside a mandate for the Treasury to investigate the associated risks.

New Token Debuts and Market Activity

The recently launched BERA token from Berachain has already seen a staggering trading volume of $4.8 billion, with its price currently at $7.60, down from a peak of $14 recorded yesterday.

What to Watch in the Coming Days

Crypto Events:

– February 13: Kraken begins delisting stablecoins USDT, PYUSD, EURT, TUSD, and UST for EEA clients, with the process concluding on March 31.

– February 18, 10:00 a.m.: FTX Digital Markets, a subsidiary of FTX based in the Bahamas, will commence creditor reimbursements.

Macro Events:

– February 7, 8:30 a.m.: U.S. Bureau of Labor Statistics to release the January Employment Situation report, with estimates of 170K nonfarm payrolls versus a previous 256K.

– February 8, 8:30 p.m.: China’s National Bureau of Statistics will publish January’s Consumer Price Index report.

Earnings Reports:

– February 10: Canaan (CAN) pre-market, estimated at $-0.08.

– February 11: HIVE Digital Technologies (HIVE) post-market, estimated at $-0.11.

Token Events and Governance Discussions

Several decentralized autonomous organizations (DAOs) are currently discussing important governance changes:

– OsmosisDAO is considering a proposal to use 50% of taker fees collected in OSMO for burning.

– Threshold DAO is exploring the establishment of a bond program to improve liquidity for its stablecoin.

– Sky DAO is voting on an executive proposal to reduce savings rates and allocate funds for integration boosting.

Upcoming Conferences and Networking Opportunities

CoinDesk’s Consensus will take place in Hong Kong from February 18-20 and in Toronto on May 14-16. Participants can save 15% on passes using the code DAYBOOK.

– February 7: Solana APEX in Mexico City.

– February 13-14: The 4th Edition of NFT Paris.

– February 18-20: Consensus Hong Kong.

– February 19: Sui Connect in Hong Kong.

– February 23 to March 2: ETHDenver 2025 in Denver, Colorado.

Market Movements and Key Statistics

As of the latest update:

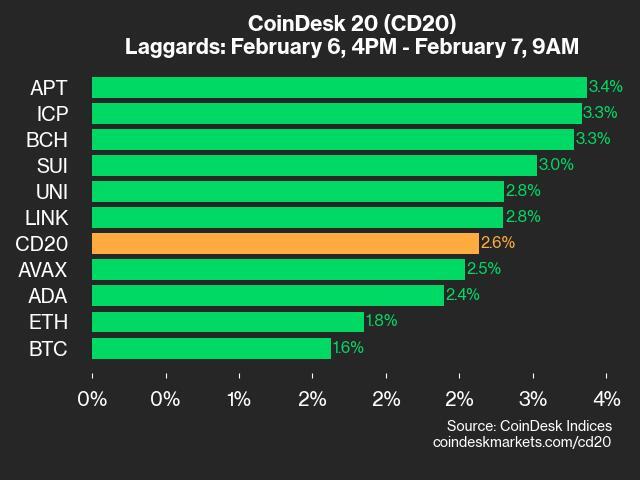

– Bitcoin (BTC) has seen a slight increase of 1.24% from 4 p.m. ET Thursday, currently priced at $97,686.16.

– Ethereum (ETH) is up 1.61% at $2,757.18.

– The CoinDesk 20 index has risen by 1.99% to 3,215.42.

Technical Analysis Insights

Bitcoin is currently trading below the Ichimoku cloud, a key indicator used by traders to assess momentum and trend strength. A breach below this cloud typically signals a bearish market trend.

Overview of Crypto Equities

Here’s a snapshot of key crypto-related equities:

– MicroStrategy (MSTR): Closed at $325.46 (-3.34%), currently at $327.50 in pre-market.

– Coinbase Global (COIN): Closed at $270.37 (-1.73%), currently at $272.39 in pre-market.

– Galaxy Digital Holdings (GLXY): Closed at C$27.07 (-2.13%).

Conclusion

As Bitcoin grapples with market uncertainty and awaits pivotal jobs data, investors are keeping a close watch on legislative developments and upcoming economic indicators. The landscape remains fluid, with potential volatility on the horizon as the market reacts to forthcoming reports and regulations.