By Omkar Godbole (All times ET unless indicated otherwise)

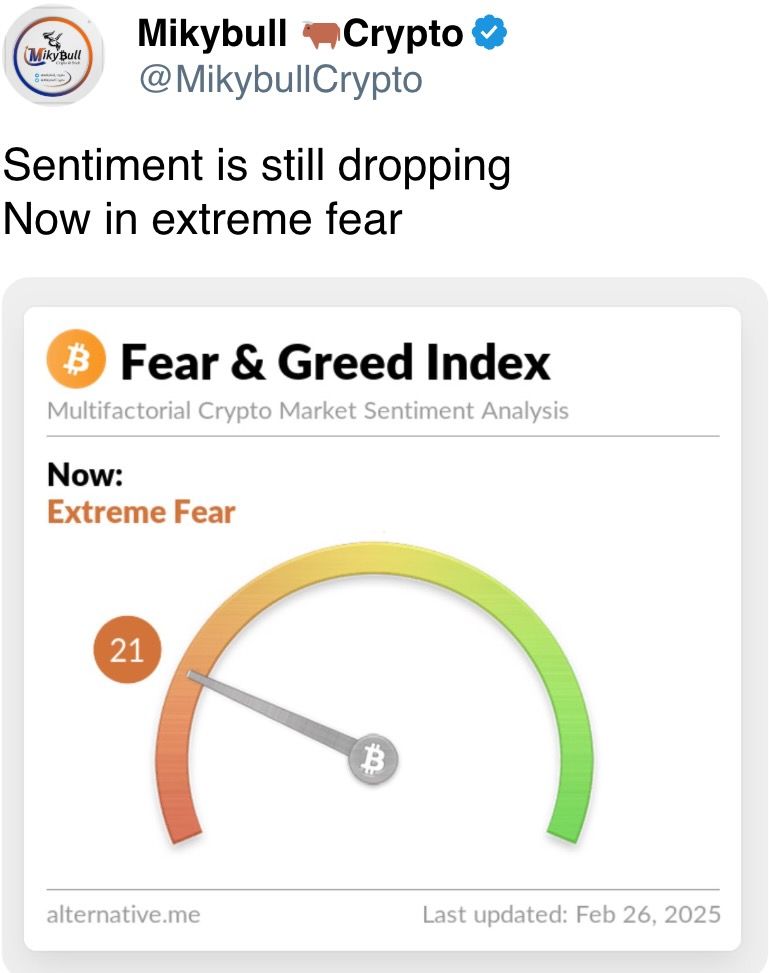

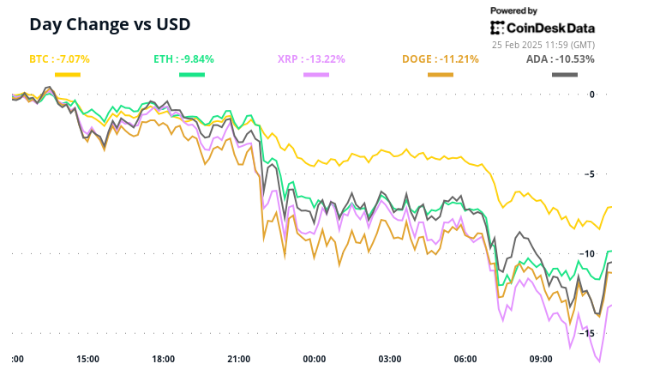

The cryptocurrency market is in recovery mode today, attempting to regain stability following a notable drop in prices. On-chain indicators for Bitcoin suggest that some investors may be capitulating, paving the way for potential market shifts. Among the standout performers, MakerDAO’s MKR has surged 20% in just 24 hours due to the DAO’s strategic buyback and burn initiatives.

Emerging Tokens on the Rise

In addition to MKR, several other tokens are seeing significant gains. The native token of the Story Protocol, IP, has nearly doubled in value over the past two weeks, thanks to its recent listing on South Korean exchanges, resulting in a remarkable 40% price increase. Other notable performers include Celestia’s TIA, as well as XDC, QNT, and HYPE. Whale activity, as tracked by blockchain analytics platform Lookonchain, indicates that large investors are capitalizing on the price dip in HYPE, while XRP remains resilient, clinging to a crucial Fibonacci level that keeps bullish sentiment alive.

Market Sentiment and Macroeconomic Factors

Matthew Hougan, the Chief Investment Officer at Bitwise Asset Management, notes that the crypto market is adjusting to the end of the recent memecoin frenzy. He believes that the focus may soon shift to more productive sectors, such as stablecoins, real-world assets, and DeFi projects. However, Hougan warns that until these areas start to make a noticeable impact, the market may continue to experience a lack of momentum.

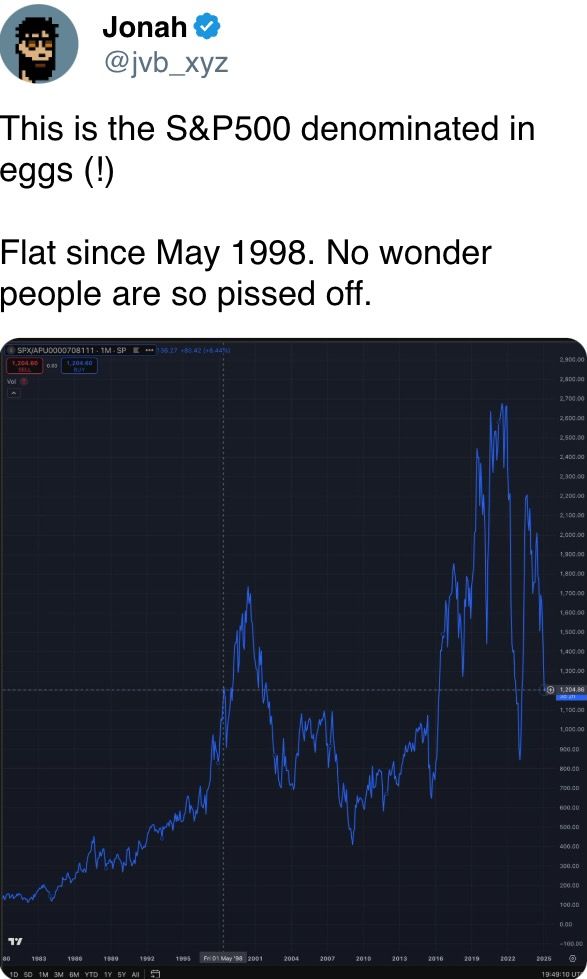

On the macroeconomic front, the optimism following the November 4 elections is giving way to increased caution. The latest U.S. consumer confidence report revealed a drop to an eight-month low, with inflation expectations rising to their highest level in 1.5 years. Concerns surrounding President Trump’s tariffs have been a recurring theme in surveys from both households and businesses.

This pessimistic sentiment, combined with a strengthening yen, may place limitations on the upside potential for risk assets in the near future. Belgium’s central bank head, Pierre Wunsch, has cautioned that the European Central Bank (ECB) may be at risk of excessive rate cuts, while the Federal Reserve is unlikely to initiate quantitative easing (QE) anytime soon.

Upcoming Legislative Developments

A significant event to keep an eye on is the Senate Banking Committee hearing scheduled for Wednesday, led by Senator Cynthia Lummis. The hearing, titled “Exploring Bipartisan Legislative Frameworks for Digital Assets,” aims to revisit current crypto regulations, making it a crucial moment for the industry.

What’s on the Horizon: Key Events to Watch

Crypto Highlights

- Feb. 26, 8:30 a.m.: Cosmos (ATOM) network upgrade (version v22.2.0).

- Feb. 26: RedStone (RED) farming begins on Binance Launchpool.

- Feb. 27, 4:00 a.m.: Alchemy Pay (ACH) community AMA on Discord.

- Feb. 27: Mainnet launch of Solana-based L2 Sonic SVM (SONIC) dubbed «Mobius.»

- March 1: Spot trading on Arkham Exchange goes live in 17 U.S. states.

- March 5 (tentative): Testing of Ethereum’s Pectra upgrade on the Sepolia testnet begins at epoch 222464.

Macroeconomic Indicators

- Feb. 26, 10:00 a.m.: U.S. Census Bureau releases January’s New Residential Sales report.

- Feb. 26-27: The first G20 finance ministers and central bank governors meeting of 2025 in Cape Town.

- Feb. 27, 8:30 a.m.: U.S. Bureau of Economic Analysis releases Q4 GDP (second estimate).

- Feb. 27, 8:30 a.m.: U.S. Department of Labor releases weekly unemployment insurance claims for the week ending Feb. 22.

Token Governance and Unlock Events

Token Governance Initiatives

Frax DAO is currently deliberating on a proposal to upgrade its protocol, which includes renaming FXS to FRAX, making it the gas token on Fraxtal, and introducing a tail emission plan with gradually decreasing emissions. Meanwhile, DYdX DAO is voting on a significant distribution of $1.5 million in DYDX tokens from its community treasury as part of its trading season 9 incentives program.

Upcoming Unlock Events

- Feb. 28: Optimism (OP) to unlock 2.32% of circulating supply worth $33.97 million.

- Mar. 1: DYdX to unlock 1.14% of circulating supply worth $5.76 million.

- Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating supply worth $12.81 million.

- Mar. 1: Sui (SUI) to unlock 0.74% of circulating supply worth $68.90 million.

- Mar. 2: Ethena (ENA) to unlock 1.3% of circulating supply worth $16.47 million.

- Mar. 7: Kaspa (KAS) to unlock 0.63% of circulating supply worth $14.85 million.

- Mar. 8: Berachain (BERA) to unlock 9.28% of circulating supply worth $70.90 million.

Upcoming Token Listings

- Feb. 26: Moonwell (WELL) to be listed on Kraken.

- Feb. 27: Venice token (VVV) to be listed on Kraken.

- Feb. 28: Worldcoin (WLD) to be listed on Kraken.

Conferences to Note

Upcoming Conferences

Several key events are on the calendar for crypto enthusiasts:

- May 14-16: CoinDesk’s Consensus in Toronto.

- March 2-3: Crypto Expo Europe in Bucharest, Romania.

- March 8: Bitcoin Alive in Sydney, Australia.

- March 10-11: MoneyLIVE Summit in London.

- March 13-14: Web3 Amsterdam ‘25 in the Netherlands.

- March 19-20: Next Block Expo in Warsaw, Poland.

- March 26: DC Blockchain Summit 2025 in Washington.

- March 28: Solana APEX in Cape Town, South Africa.

Token Insights and Market Dynamics

Token Insights

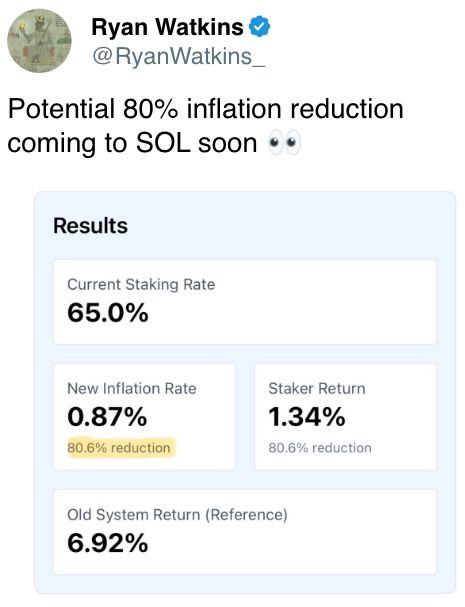

Solana is considering a governance proposal to reform its monetary policy through SIMD-0228, which would introduce a dynamic emissions model for SOL tokens. This change aims to address concerns over inflation by transitioning away from the current fixed emissions model, which has led to a significant increase in SOL’s circulating supply.

Meanwhile, the Story Protocol’s IP token has bucked the bearish trend in the crypto market, outperforming the broader CoinDesk 20 Index as traders express confidence in the tokenization of intellectual property.

In the wake of a $1.5 billion hack, cryptocurrency exchange Bybit has initiated a «war against Lazarus,» a campaign aimed at crowdsourcing investigative efforts against the North Korean-linked hacking group.

Market Analytics and Trading Dynamics

Market Movements

Bitcoin (BTC) has risen by 1% since 4 p.m. ET on Tuesday, now valued at $89,193.77, while Ethereum (ETH) has decreased by 0.36% to $2,487.88. The CoinDesk 20 index is up 0.42% to 2,882.89. Other notable metrics include:

- BTC funding rate at 0.0005% (0.6% annualized) on OKX.

- Ether CESR Composite Staking Rate up 29 basis points at 3.28%.

Current Market Statistics

As of now, Bitcoin dominance stands at 61.11%, with the Ethereum-to-Bitcoin ratio at 0.02793. The seven-day moving average for hashrate is at 746 EH/s, and the hashprice is valued at $52.40. The total fees collected are at 11.39 BTC (approximately $1.1 million).

Technical Insights and Future Projections

Technical Analysis

The hourly chart for Bitcoin indicates a bullish bias in the MACD histogram since late Tuesday, yet price progress remains minimal. The existing divergence between price and MACD, along with the downward trend in key averages, suggests the potential for further selling ahead of a meaningful market bottom. A decisive move above $90,000 would be necessary to negate the current bearish outlook.

Crypto Equities and ETF Flows

Crypto Equities Performance

Recent performance of key crypto equities includes:

- MicroStrategy (MSTR) closed at $250.51, down 11.41%, but has risen 3.66% in pre-market.

- Coinbase Global (COIN) closed at $212.49, down 6.42%, but is up 2.04% in pre-market.

- Galaxy Digital Holdings (GLXY) closed at C$20.09, down 7.84%.

- MARA Holdings (MARA) closed at $12.41, down 10.62%, with a pre-market rise of 2.86%.

- Riot Platforms (RIOT) closed at $9.32, down 6.71%, but is up 2.79% in pre-market.

ETF Flows Overview

The latest data on spot Bitcoin ETFs indicates a daily net outflow of $937.7 million, bringing cumulative net flows to $38.09 billion with total BTC holdings at approximately 1,157 million. For spot Ethereum ETFs, there was a daily net outflow of $50.1 million, with cumulative net flows at $3.02 billion and total ETH holdings around 3.750 million.

Insights from Overnight Flows and Market Sentiment

Overnight Market Flows

Chart of the Day

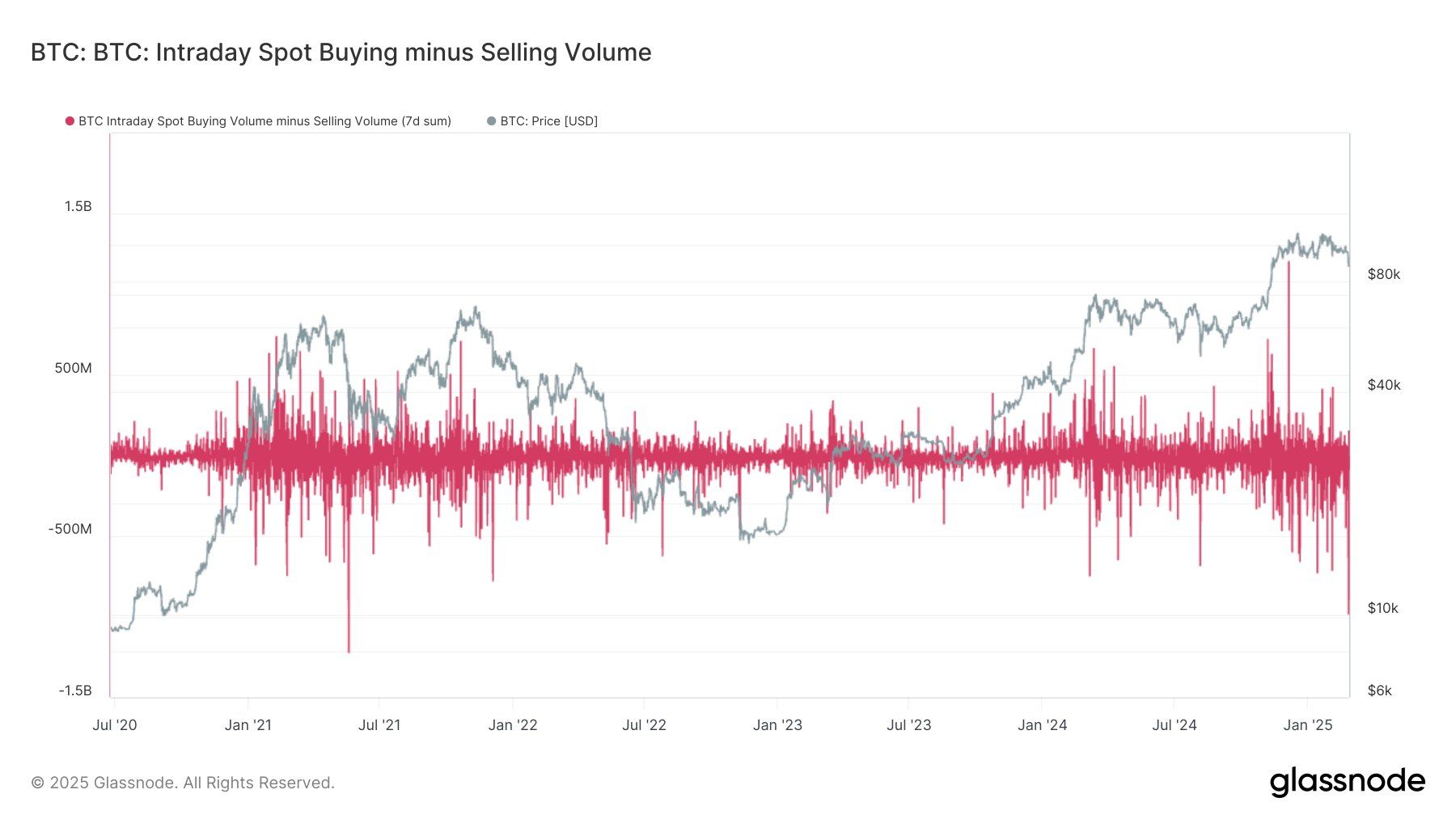

According to analysis from Glassnode, the net selling volume of Bitcoin on Tuesday was the most significant since May 2021. This could indicate that weaker hands have capitulated, potentially leaving the market in a healthier state moving forward.

While You Were Sleeping

Recent developments include:

- XRP and BNB show slight recovery as Bitcoin approaches $90K following Tuesday’s significant drop.

- Analysts believe Tuesday’s bloodbath may have marked the bottom for Bitcoin prices based on on-chain signals.

- U.S. Bitcoin ETFs experienced record daily outflows exceeding $930 million, raising concerns as carry trades lose appeal compared to the 10-Year Treasury Note.

- Circle advocates for stablecoin issuers to be registered in the U.S.

- Treasury yields have slightly rebounded, while the dollar faces pressure from growth concerns.

- G20 meeting in South Africa is notable for the absence of key finance ministers, raising doubts about global cooperation.

In the Ether