By Omkar Godbole (All times ET unless indicated otherwise)

The cryptocurrency market is buzzing with enthusiasm as social media influencers and industry leaders share their bullish sentiments. This wave of optimism has positively influenced market prices, particularly for Bitcoin, which has surged to over $98,000 from $96,900. Notably, Eric Trump, son of former President Donald Trump, has encouraged family-affiliated World Liberty Financial to invest in Bitcoin, furthering the positive narrative.

A Promising Outlook for the Crypto Market

Charles Hoskinson, the founder of Cardano, has been vocal about the potential for a significant bull market ahead. He pointed out that the recent downturn was more severe than the collapses of Luna and FTX, yet the market has swiftly rebounded. «In just 24 hours, we saw $710 billion in losses and 740,000 traders liquidated, yet we are on the path to recovery. 2025 is Crypto’s year,» Hoskinson stated. This positive sentiment has also led to a 4% increase in Cardano’s ADA token, with other major altcoins like XRP, SOL, and ETH experiencing similar gains.

Ether Sees Institutional Interest Despite Analyst Skepticism

While analysts remain cautious about Ether, institutional investors seem to be taking a different approach. Data from on-chain analysis firm Lookonchain revealed that a trading firm withdrew 62,381 Ether from centralized exchanges in the last two days, transferring them to Coinbase Prime. Additionally, market maker Wintermute has reported robust over-the-counter demand for Ether, indicating a potential shift in market dynamics.

In the realm of crypto news, Conor Grogan, a director at Coinbase, speculated that the crypto exchange Kraken may have insights into the true identity of Bitcoin’s creator, Satoshi Nakamoto. Grogan mentioned that Nakamoto could potentially own 1.096 million BTC, with a paper wealth surpassing that of Bill Gates. Meanwhile, a new bill has been introduced in the U.S. Senate aiming to regulate stablecoins, which could stimulate demand for U.S. Treasuries and promote financial innovation, according to FXPro’s chief market analyst, Alex Kuptsikevich.

Macro Trends Impacting the Market

On the macroeconomic front, currencies sensitive to China, such as the Australian and New Zealand dollars, have weakened against the U.S. dollar but remain within recent trading ranges. This stability suggests that markets do not anticipate a prolonged U.S.-China trade conflict. Former President Trump shows no eagerness to engage with President Xi Jinping, which may limit gains in risk assets temporarily.

U.S. Treasury Secretary Scott Bessent has indicated that the Trump administration aims to reduce U.S. Treasury yields, a move that could bode well for risk assets. However, if Thursday’s jobless claims and Unit Labor Costs data reflect a strong economy, the 10-year yield might spike, potentially curtailing Bitcoin’s upward momentum.

What to Watch: Upcoming Crypto and Macro Events

Crypto Events:

— **Feb. 6**: Berachain (BERA) mainnet launch and initial creation/distribution of native tokens, with 15.75% airdropped to community members.

— **Feb. 6, 8:00 a.m.**: Shentu Chain network upgrade (v2.14.0).

— **Feb. 13**: Gradual delisting of USDT, PYUSD, EURT, TUSD, and UST stablecoins for EEA clients by Kraken, concluding on March 31.

— **Feb. 18, 10:00 a.m.**: FTX Digital Markets will begin reimbursing creditors.

Macro Events:

— **Feb. 6, 7:00 a.m.**: Bank of England releases Monetary Policy Summary and Minutes.

— **Feb. 6, 8:30 a.m.**: U.S. Department of Labor to release Unemployment Insurance Weekly Claims report.

— **Feb. 7, 8:30 a.m.**: U.S. Bureau of Labor Statistics releases January’s Employment Situation report.

Token Events and Governance Discussions

Governance votes are heating up as various DAOs discuss significant changes:

— **OsmosisDAO** is considering a new plan to use 50% of collected taker fees in OSMO for burns.

— **Threshold DAO** is addressing liquidity challenges for its stablecoin through a proposed bond program.

— **Bonk DAO** is voting on burning 2.025 trillion BONK tokens to celebrate the end of the BONKDragon campaign and the upcoming Lunar New Year.

Additionally, several DAO calls are scheduled:

— **Feb. 6**: Livepeer (LPT) Core Dev Call on Discord.

— **Feb. 6, 2 p.m.**: Arbitrum open call discussing AI in decentralized finance applications.

Market Movements and Performance Highlights

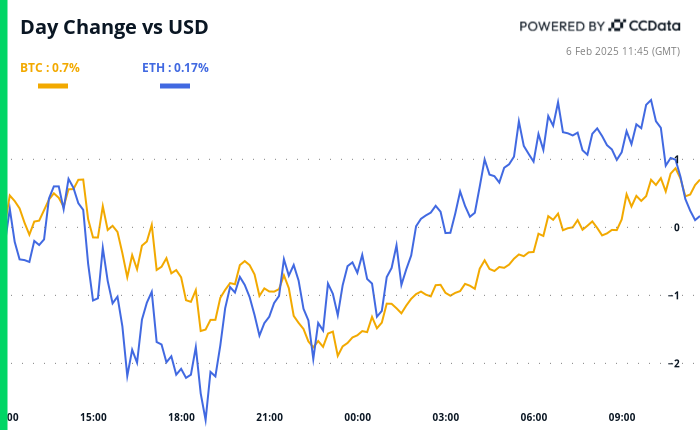

Bitcoin (BTC) has increased 1.7% over the last 24 hours, currently priced at $98,682.38. Ethereum (ETH) has also seen a rise of 4.15%, trading at $2,812.62. The CoinDesk 20 index has gained 1.54%, reaching 3,281.41.

In the equities market:

— MicroStrategy (MSTR) closed at $336.70, down 3.33%.

— Coinbase (COIN) ended at $275.14, down 1.87%.

— Galaxy Digital (GLXY) closed at C$27.66, down 0.04%.

Technical Analysis and Bitcoin Statistics

Recent analysis reveals that the BTC/JPY pair has broken through a bullish trendline connecting the higher lows from October and November. This development may embolden bearish sentiment, although the pair remains within a sideways trading range.

Bitcoin Stats:

— BTC Dominance: 61.45%

— Ethereum to Bitcoin Ratio: 0.02867

— Overall Hashrate (seven-day average): 808 EH/s

In summary, the cryptocurrency market is experiencing a resurgence of bullish sentiment, led by influential figures and institutional interest, while macroeconomic factors continue to shape the landscape. As we look ahead, upcoming events in the crypto and macro sectors could provide further insights into the market’s trajectory.