By James Van Straten (All times ET unless indicated otherwise)

The ongoing developments under the Trump administration continue to captivate the financial world, and today appears to be no exception.

Trump’s Bitcoin Enthusiasm Influences Global Perspectives

Recent comments from President Trump regarding Bitcoin are prompting other nations to reconsider their stance on this digital asset. A notable example is the Czech National Bank, where Governor Aleš Michl plans to propose a strategy to acquire billions of euros in Bitcoin for the bank’s reserves. If this plan is approved, the Czech National Bank would mark a historic milestone as the first Western central bank to officially hold Bitcoin as a reserve asset. Michl is scheduled to present this ambitious plan to the bank’s board tomorrow.

FOMC Meeting: The Market Awaits Direction

In addition to international developments, today marks the highly anticipated meeting of the Federal Open Market Committee (FOMC). Analysts predict that the benchmark fed funds rate will remain steady at 4.25%-4.50%. However, the market is keenly focused on whether Fed Chair Jerome Powell will take a hawkish or dovish stance, as his comments could significantly influence asset prices.

Market Reactions and Trends

As concerns over the Chinese DeepSeek AI program fade, Bitcoin’s price has climbed back above $102,000. Meanwhile, U.S. equities are approaching a new all-time high, buoyed by a notable recovery in shares of Nvidia (NVDA), which surged nearly 10%.

Investors should prepare for potential volatility following the market close, as major technology companies, including Tesla (TSLA), are set to release their earnings reports.

What to Watch in the Crypto Space

Upcoming Crypto Events

— **Jan. 29**: Cardano’s Plomin hard fork network upgrade.

— **Jan. 29**: Ice Open Network (ION) mainnet launch.

— **Jan. 31**: Crypto.com will suspend purchases of various cryptocurrencies in the EU, including USDT and WBTC, to comply with MiCA regulations. Withdrawals remain supported through Q1.

— **Feb. 2, 8:00 p.m.**: Core blockchain Athena hard fork network upgrade (v1.0.14).

— **Feb. 4**: MicroStrategy (MSTR) Q4 and FY 2024 earnings report.

— **Feb. 4**: Pepecoin (PEPE) halving at block 400,000.

— **Feb. 5, 3:00 p.m.**: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

— **Feb. 6, 8:00 a.m.**: Shentu Chain network upgrade (v2.14.0).

— **Feb. 12**: Hut 8 Corp. (HUT) Q4 2024 earnings report.

— **Feb. 13 (after market close)**: Coinbase Global (COIN) Q4 2024 earnings report.

— **Feb. 15**: Qtum (QTUM) hard fork network upgrade at block 4,590,000.

— **Feb. 18 (after market close)**: Semler Scientific (SMLR) Q4 2024 earnings report.

Macro Events to Monitor

— **Jan. 29, 8:45 a.m.**: Bank of Canada releases its quarterly Monetary Policy Report.

— **Jan. 29, 9:45 a.m.**: The Bank of Canada announces its interest-rate decision, followed by a press conference at 10:30 a.m.

— **Jan. 29, 2:00 p.m.**: FOMC announces the U.S. central bank’s interest-rate decision, followed by a press conference at 2:30 p.m.

— **Jan. 30, 8:30 a.m.**: U.S. Bureau of Economic Analysis releases Q4 Advance GDP report.

— **Jan. 30, 4:30 p.m.**: The Federal Reserve releases its H.4.1 report on reserve balances.

— **Jan. 30, 6:30 p.m.**: Japan’s December unemployment report will be released.

Governance Votes and Token Events

Several governance votes are taking place across different DAOs:

— ENS DAO is considering converting 6,000 ETH into USDC to secure a 12-month operational runway.

— Stargate Finance DAO is initiating a $10 million allocation in STG tokens for initiatives on Hydra chains.

— Pocket DAO is voting on establishing a Compensation Committee to oversee its compensation scheme.

Unlock Events

Upcoming unlock events include:

— **Jan. 28**: Tribal Token (TRIBL) unlocking 14% of its circulating supply worth $60 million.

— **Jan. 31**: Optimism (OP) unlocking 2.32% of its circulating supply worth $52.9 million.

— **Feb. 1**: Sui (SUI) unlocking about 2.13% of its circulating supply worth $226 million.

Conferences on the Horizon

The crypto community can look forward to several key conferences:

— **Jan. 30-31**: Ethereum Zurich 2025.

— **Jan. 30-Feb. 1**: Crypto Gathering 2025 in Miami Beach, Florida.

— **Feb. 1-28**: Mammathon global hackathon for Celestia (online).

— **Feb. 18-20**: CoinDesk’s Consensus Hong Kong.

Updates from the Crypto Market

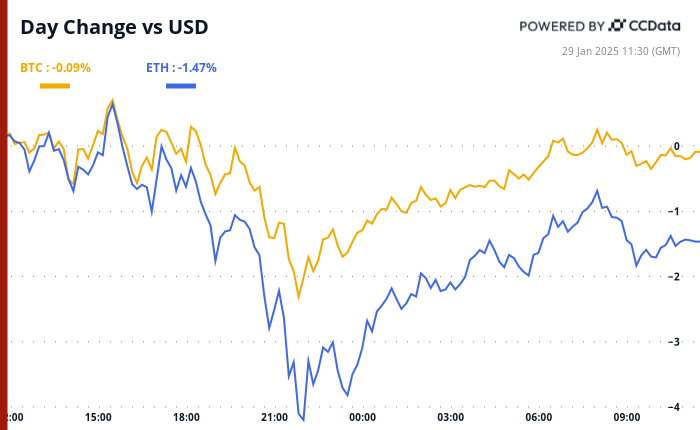

Bitcoin and Ethereum Market Movements

— BTC has risen 2.21% to $102,509.74.

— ETH has increased by 2.7% to $3,134.98.

— The CoinDesk 20 index is up 0.47% to 3,733.87.

Bitcoin Statistics

— BTC Dominance: 59.37%

— Ethereum to Bitcoin Ratio: 0.03063

— Hashrate (7-day moving average): 780 EH/s

Technical Analysis

Recent trends indicate that Bitcoin’s momentum against the yen is stalling, as evidenced by the MACD histogram suggesting a weakening upward trend. This comes after the Bank of Japan raised interest rates to the highest level in 17 years.

Crypto Equities Overview

— MicroStrategy (MSTR) closed at $335.93, down 3.45%.

— Coinbase Global (COIN) increased by 1.38% to $281.82.

— Galaxy Digital Holdings (GLXY) closed at C$27.87, up 1.86%.

ETF Flows and Market Insights

— Spot BTC ETFs posted daily net flows of $18 million and cumulative net flows of $39.5 billion.

— Total BTC holdings across spot ETFs are approximately 1.171 million.

In Summary

As the crypto landscape continues to evolve, stakeholders should stay tuned for key developments, including the upcoming FOMC meeting and the growing interest in Bitcoin from central banks like the Czech National Bank. The interplay between market movements and regulatory measures will remain crucial for investors navigating this dynamic environment.