By James Van Straten (All times ET unless indicated otherwise)

Recent Developments in Bitcoin’s Price Action

The latest fluctuations in Bitcoin’s (BTC) price have sparked a debate among investors: should one «buy when there is blood in the streets,» or is it wiser to «not catch a falling knife»? This philosophical dilemma is particularly relevant today, following Bitcoin’s steepest three-day decline since the FTX collapse in 2022. After this drop, BTC is now 25% below its all-time high recorded in January, despite the pro-crypto stance of President Donald Trump’s administration.

Investor sentiment has been significantly impacted by the largest hack in crypto history, coupled with a surge in memecoin activity that has siphoned liquidity from the broader market. However, it’s essential to remember that significant corrections are part of Bitcoin’s historical pattern. In previous bull markets, Bitcoin has experienced pullbacks as steep as 35%. Given that BTC hasn’t faced a substantial decline since last August, the current market correction can be seen as relatively normal.

Market Analysis and Trends

According to CoinDesk’s research, Bitcoin has been trading within a narrow range for an extended period, making a breakout inevitable. On-chain data indicates that Bitcoin recently bounced off its 200-day moving average, approximately at $81,800. While short-term holders—those who have owned BTC for 155 days or less—are selling at the highest level since August, this behavior often signals a form of market capitulation.

Despite the negative sentiment, there are positive developments to note. BlackRock’s IBIT experienced record outflows on Wednesday, but Core Scientific (CORZ) announced a significant expansion deal, and MARA Holdings (MARA) revealed strong earnings, with both stocks rising by over 10% before market opening. Additionally, NVIDIA (NVDA) exceeded fourth-quarter estimates, providing some reassurance to investors.

Upcoming Events to Monitor

Crypto Events:

— February 27: Launch of Solana-based L2 Sonic SVM (SONIC) mainnet, dubbed “Mobius.”

— March 1: Arkham Exchange begins spot trading across 17 U.S. states.

— March 5 (tentative): Ethereum’s Pectra upgrade testing starts on the Sepolia testnet at epoch 222464.

Macro Economic Events:

— February 27: Brazil’s employment data for January will be released, with an estimated unemployment rate of 6.6% (previously 6.2%).

— February 27: Mexico’s January employment data is expected to show an unemployment rate of 2.7% (previously 2.4%).

— February 27: The U.S. Bureau of Economic Analysis will publish the Q4 GDP second estimate, with various estimates for core PCE prices and GDP growth rate.

Token Governance and Community Updates

Governance Initiatives:

— The DYdX DAO is voting on distributing $1.5 million in DYDX tokens from the community treasury as part of its incentives program.

— On February 27, IOTA (IOTA) will hold an AMA session with co-founder Dominik Schiener.

— VeChain (VET) will provide its monthly updates during a community call on February 27.

Token Unlocking Events:

— February 28: Optimism (OP) will unlock 2.32% of its circulating supply, valued at approximately $36.67 million.

— March 1: Various tokens, including DYdX and ZetaChain, will unlock portions of their circulating supply.

Conferences to Attend

— CoinDesk’s Consensus event will occur in Toronto from May 14-16, offering a 15% discount on passes with the code DAYBOOK.

— Other significant events include ETHDenver 2025 (Denver), Crypto Expo Europe (Bucharest), and Bitcoin Alive (Sydney).

Market Movements and Financial Updates

Current Market Overview:

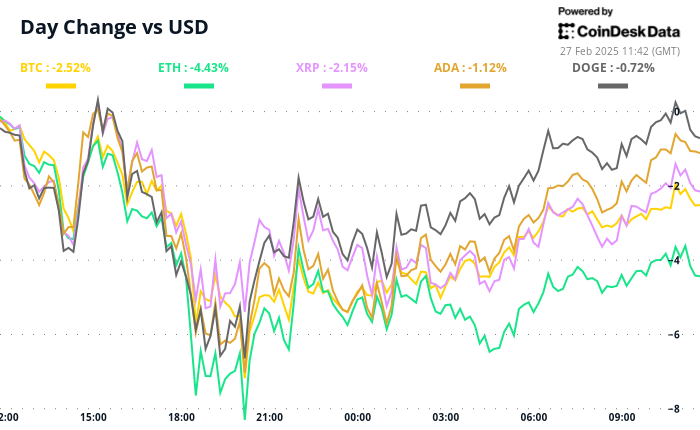

— Bitcoin is trading at $86,735.19, showing a 3% increase since 4 p.m. ET on Wednesday, despite a 24-hour decline of 2.12%.

— Ethereum (ETH) is up 1.98% at $2,378.49, while the CoinDesk 20 index has increased by 2.98% to 2,821.02.

Technical Analysis Insights:

BTC has recently broken down from a double top formation, revealing a critical support level below $74,000. The price chart indicates a lack of other support levels between $90,000 and $74,000.

Crypto Equities Performance:

— MicroStrategy (MSTR) closed Wednesday at $263.27, up 5.09%.

— Coinbase Global (COIN) ended at $212.96, marking a slight increase.

— MARA Holdings (MARA) saw a notable rise of 12.93% in pre-market trading.

Investor Sentiment and Market Outlook

The current market correction, while unsettling, is a familiar occurrence in the volatile world of cryptocurrencies. As investors navigate these turbulent waters, keeping an eye on upcoming events and market indicators will be crucial for making informed decisions.

In the Ether: Community Updates and Observations

The memecoin launchpad, Pump.fun, has experienced a significant decline in activity amid the recent market downturn. After achieving impressive growth in October 2024, the platform has seen token launches decrease by over 60%. This decline coincides with Solana’s SOL token dropping more than 40% since the beginning of the year.

With the crypto landscape constantly evolving, investors and enthusiasts must stay informed and adaptable to navigate the complexities of the market effectively.