By Omkar Godbole (All times ET unless indicated otherwise)

The Current State of the Crypto Market

The cryptocurrency market is currently experiencing a period of stagnation, with Bitcoin taking a breather from its recent bullish trend. This pause comes amid renewed tariff threats from former President Trump, which have also contributed to soaring gold prices and a strengthened demand for the U.S. dollar.

Despite Bitcoin’s sluggish movement, there is notable activity in other areas of the market. The recent listing of the VIRTUAL token on Upbit has led to a significant price surge. Similarly, Hyperliquid’s HYPE token has gained 3%. Litecoin is also seeing increased interest, with its perpetual futures open interest on centralized exchanges climbing to 5.19 million LTC—its highest level since December 9, as reported by Coinglass. This uptick suggests fresh capital is entering the market, likely fueled by growing anticipation for a spot ETF listing in the U.S.

USDC Dominates January Performance

In a remarkable turn of events, USDC has emerged as the standout performer in January, demonstrating a market cap growth of 21%, bringing its total to $53.12 billion. This represents the strongest month for USDC since May 2021, according to TradingView data. In contrast, USDT, the leading dollar-pegged stablecoin, saw only a marginal increase of 1%, while Bitcoin itself experienced a respectable growth of 10%.

The outperformance of USDC can be attributed to its compliance with Europe’s MiCA regulations, which has positioned it favorably compared to competitors like USDT, which are facing significant regulatory challenges. However, USDT is not out of the game; its market is rebounding, and the simultaneous growth of USDC could provide a bullish momentum for the overall crypto market.

Market Outlook: Key Economic Indicators Ahead

As we navigate the macroeconomic landscape, all eyes are on the upcoming U.S. core PCE data—the Federal Reserve’s preferred gauge for inflation. A robust headline figure is anticipated, with the core reading (excluding food and energy prices) expected to show positive trends that could help Bitcoin break free from its current price stagnation near $104,000.

Nevertheless, ING warns that the dollar may remain strong leading into the weekend. They note, “If no updates on Canada and Mexico emerge by today, there is a risk that the dollar could strengthen further as markets begin to factor in a higher likelihood of tariffs being implemented tomorrow.” Therefore, investors should remain vigilant.

What’s Coming Up in the Crypto Sphere

Key Dates to Note:

— **January 31:** Crypto.com will suspend purchases of USDT, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO, and XSGD in the EU to comply with MiCA regulations, while withdrawals will be supported through Q1.

— **February 2, 8:00 p.m.:** Core blockchain Athena hard fork network upgrade (v1.0.14).

— **February 4:** Pepecoin (PEPE) halving; rewards will drop to 31,250 PEPE at block 400,000.

— **February 5, 3:00 p.m.:** Boba Network’s Holocene hard fork network upgrade for its Ethereum-based layer-2 mainnet.

— **February 5 (after market close):** MicroStrategy (MSTR) Q4 FY 2024 earnings report.

— **February 6, 8:00 a.m.:** Shentu Chain network upgrade (v2.14.0).

— **February 11 (after market close):** Exodus Movement (EXOD) Q4 2024 earnings.

— **February 12 (before market open):** Hut 8 (HUT) Q4 2024 earnings.

— **February 13:** CleanSpark (CLSK) Q1 FY 2025 earnings.

— **February 13 (after market close):** Coinbase Global (COIN) Q4 2024 earnings.

— **February 15:** Qtum (QTUM) hard fork network upgrade at block 4,590,000.

— **February 18 (after market close):** Semler Scientific (SMLR) Q4 2024 earnings.

— **February 20 (after market close):** Block (XYZ) Q4 2024 earnings.

— **February 26:** MARA Holdings (MARA) Q4 2024 earnings.

— **February 27:** Riot Platforms (RIOT) Q4 2024 earnings.

— **March 4:** Cipher Mining (CIFR) Q4 2024 earnings.

Upcoming Macro Events:

— **January 31, 8:30 a.m.:** The U.S. Bureau of Economic Analysis (BEA) will release December’s Personal Income and Outlays report. Expect the Core PCE Price Index MoM to be estimated at 0.2% vs. Prev. 0.1%, and YoY at 2.8% vs. Prev. 2.8%.

— **February 2, 8:45 p.m.:** China’s Caixin will release January’s Manufacturing PMI report, estimated at 50.5 vs. Prev. 50.5.

Token Events and Governance Updates

Governance Votes:

— Compound DAO is currently voting on an upgrade of its governance contracts to OpenZeppelin’s modern Governor implementation.

— Balancer DAO is considering a token swap involving 200,000 BAL tokens and approximately 631,000 COW tokens.

Unlocks:

— **January 31:** Optimism (OP) will unlock 2.32% of its circulating supply, valued at $46.39 million.

— **February 1:** Sui (SUI) will unlock about 2.13% of its circulating supply, valued at $261.91 million.

— **February 2:** Ethena (ENA) will unlock approximately 1.34% of its circulating supply, valued at $29.53 million.

Token Listings:

— **January 31:** Movement (MOVE), Virtuals Protocol (VIRTUAL), and Sundog (SUNDOG) will be listed on Indodax.

Conferences on the Horizon

— **January 31:** Crypto Peaks 2025 (Palisades, California).

— **February 1:** Ethereum Zurich 2025.

— **February 1:** Plan B Forum (San Salvador, El Salvador).

— **February 1:** Crypto Gathering 2025 (Miami Beach, Florida).

— **February 1:** CryptoXR 2025 (Auxerre, France).

— **February 1:** Oasis Onchain 2025 (Nassau, Bahamas).

— **February 1:** The Satoshi Roundtable (Dubai).

— **February 3:** Digital Assets Forum (London).

— **February 5-6:** The 14th Global Blockchain Congress (Dubai).

— **February 6:** Ondo Summit 2025 (New York).

— **February 7:** Solana APEX (Mexico City).

— **February 13-14:** The 4th Edition of NFT Paris.

— **February 18-20:** CoinDesk’s Consensus Hong Kong.

— **February 19:** Sui Connect: Hong Kong.

— **February 23-March 2:** ETHDenver 2025 (Denver, Colorado).

— **February 25:** HederaCon 2025 (Denver).

Current Market Movements

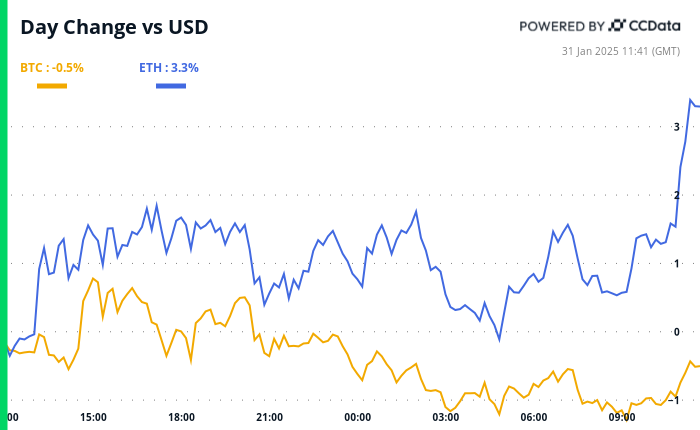

Bitcoin (BTC) is currently down 0.29% from 4 p.m. ET Thursday, trading at $104,810.50 (-0.47% over the past 24 hours). Ethereum (ETH) has seen a 2.39% increase, now at $3,324 (+3.32% over the past 24 hours). The CoinDesk 20 index has dipped slightly by 0.3% to 3,838.81, while the CESR Composite Staking Rate has risen by 4 basis points to 3.07%.

In the derivatives market, TRX, TRUMP, and OM have recorded the largest increases in perpetual futures open interest. Meanwhile, BTC and ETH open interest remains relatively unchanged, and the BTC CME basis is hovering around 10%, suggesting a balanced outlook among traders.

Bitcoin Performance Metrics

— BTC Dominance: 59.21 (-0.11%)

— Ethereum to Bitcoin Ratio: 0.03127 (0.84%)

— Hashrate (7-day moving average): 781 EH/s

— Hashprice (spot): $61.7

— Total Fees: 4.97 BTC / $522,698

— CME Futures Open Interest: 176,270 BTC

— BTC Priced in Gold: 37.3 oz

— BTC vs. Gold Market Cap: 10.60%

Technical Analysis Insights

Recent charts indicate that the $60 level has become a formidable resistance for BlackRock’s IBIT exchange-trade fund since December. Bulls have repeatedly struggled to maintain positions above this threshold. Such patterns often signal bullish exhaustion, leading to minor price pullbacks that can shake out weaker investors and set the stage for a potential upward movement.

Crypto Equity Snapshot

— **MicroStrategy (MSTR):** Closed at $340.09 (-0.34%), currently up 0.2% at $340.77 in pre-market.

— **Coinbase Global (COIN):** Closed at $301.30 (+3.54%), currently down 0.17% at $300.80 in pre-market.

— **Galaxy Digital Holdings (GLXY):** Closed at C$29.33 (+0.83%).

— **MARA Holdings (MARA):** Closed at $19.18 (+4.13%), currently up 0.36% at $19.25 in pre-market.

— **Riot Platforms (RIOT):** Closed at $11.90 (+6.06%), currently up 0.76% at $11.99 in pre-market.

— **Core Scientific (CORZ):** Closed at $12.26 (+6.98%), currently up 3.18% at $12.65 in pre-market.

— **CleanSpark (CLSK):** Closed at $10.97 (+6.92%), currently up 0.55% at $11.03 in pre-market.

— **CoinShares Valkyrie Bitcoin Miners ETF (WGMI):** Closed at $22.50 (+6.33%), currently up 3.47% at $23.28 in pre-market.

— **Semler Scientific (SMLR):** Closed at $52.15 (+0.13%).

— **Exodus Movement (EXOD):** Closed at $61.38 (-31.27%), currently down 2.23% at $60.01 in pre-market.

ETF Flows Overview

Spot BTC ETFs are experiencing significant inflows, with a daily net flow of $588.2 million and cumulative net flows reaching $40.18 billion, equating to total BTC holdings of approximately 1.18 million. Spot ETH ETFs have also seen healthy activity, with a daily net flow of $67.77 million and cumulative net flows totaling $2.73 billion, resulting in total ETH holdings of around 3.65 million.

Market Analysis and Chart Insights

The MOVE index, measuring expected volatility in the U.S. Treasury market over the next four weeks, has shown a downward trend. Historically, declining volatility in the Treasury market tends to favor riskier assets, indicating a potential positive environment for cryptocurrencies.

Recent Headlines and Developments

1. **Bitcoin Steady, Gold Tokens Shine:** Bitcoin faces challenges from tariff threats, although derivatives data indicates trader optimism remains intact amid growing interest in state-level BTC reserves.

2. **Grayscale Files SEC Proposal:** Grayscale is seeking to convert its XRP Trust into an ETF, with the proposal filed with the SEC.

3. **Surge in VIRTUAL Token:** The price of VIRTUAL, a native token of Virtuals Protocol, surged by 28% after its Upbit listing attracted interest from South Korean investors.

4. **Trump’s Tariff Threats:** Trump confirmed that 25% tariffs on imports from Mexico and Canada will start on February 1, leaving oil imports uncertain.

5. **Impact on Japan’s Economy:** Japan’s chief economist warns of potential fallout from U.S.-China trade tensions, though firms are better prepared than during Trump’s previous term.

In Conclusion

The cryptocurrency landscape is continuously evolving, with significant movements and events shaping the market’s direction. Investors should stay informed and alert to both macroeconomic indicators and specific developments within the crypto space to navigate these dynamic conditions effectively.