Las Vegas—The interest in crypto exchange-traded funds (ETFs) among financial advisors in the United States is on the rise, as many are ready to boost their investments in this innovative asset class this year.

The Shift in Perception

At the Exchange conference in Las Vegas, Todd Rosenbluth, head of research at TMX VettaFi, and Cinthia Murphy, senior investment strategist, shared insights from a comprehensive survey conducted with thousands of financial advisors nationwide. According to their findings, crypto has become a prevalent topic of discussion in the financial advisory community.

The survey results revealed that a significant 57% of advisors are planning to increase their allocations to crypto ETFs, while 42% intend to maintain their current positions. Notably, only 1% of respondents expressed a desire to decrease their investments in this sector.

Murphy remarked, “Last year, the prevailing sentiment was that investing in crypto posed a reputational risk. Today, we find that almost every advisor is equipped to engage in at least a basic conversation about cryptocurrencies.”

The Evolving Regulatory Landscape

The recent approval of spot bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) in January 2024 marks a pivotal moment for the crypto market. This approval occurred amid a more favorable regulatory environment, following a shift in administration that has embraced the crypto industry. Since the onset of the Trump presidency, both the SEC and the Commodity Futures Trading Commission (CFTC) have adopted a more accommodating stance towards cryptocurrencies, facilitating broader institutional adoption.

Key Interests Among Advisors

Survey respondents indicated a strong preference for crypto equity ETFs—funds that invest in publicly traded companies with exposure to the crypto market, such as Strategy (formerly MicroStrategy) and Tesla. Murphy noted, “Keeping up with the complexities in the crypto space can be challenging, which likely accounts for the growing popularity of crypto equity ETFs, as they offer a more tangible and understandable investment option.”

Since Trump assumed office, Michael Saylor’s MSTR stock has experienced a remarkable rally of over 100%, making crypto-linked equities increasingly attractive to both retail and institutional investors. While MSTR shares have seen some fluctuations since reaching all-time highs, the survey indicates that interest remains robust across the market.

Exploring Different ETF Types

Spot and multi-token ETFs are also gaining traction among financial advisors. Approximately 22% of respondents expressed interest in allocating funds to spot crypto ETFs, such as those tracking bitcoin (BTC) or ether (ETH). Additionally, around 19% are keen on crypto asset funds that encompass multiple tokens.

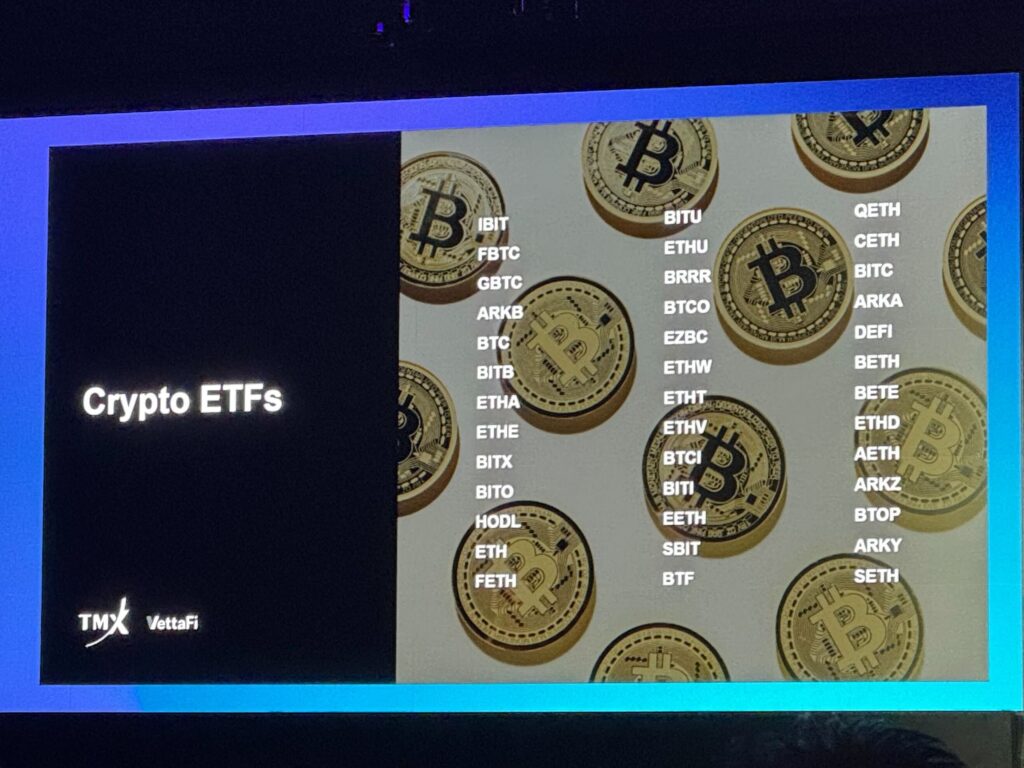

The market for crypto ETFs is expanding, with numerous products currently trading on exchanges and several others pending approval from the SEC. Recent months have witnessed a surge in index-based ETFs, which hold a diversified basket of crypto assets beyond just bitcoin and ether. Some new fund launches even incorporate managed strategies aimed at mitigating price volatility by allocating portions of the fund to U.S. Treasuries.

Looking Ahead

A variety of issuers are pursuing the introduction of additional spot crypto ETFs, including those focused on Solana (SOL), XRP, and Litecoin (LTC), although these applications are still under SEC review.

“This sector is rapidly evolving, and I strongly encourage advisors to familiarize themselves with the experts in this space. The pace of change is swift, and there is much to learn,” Murphy concluded.

Cheyenne Ligon contributed to this report.