Historic Sell-Off in Crypto ETPs

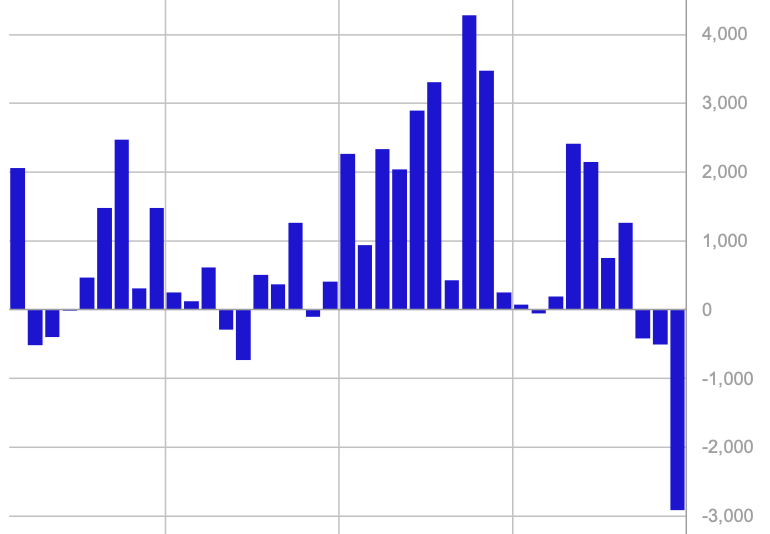

Crypto exchange-traded products (ETPs) have recently encountered their largest weekly sell-off on record, with investors withdrawing approximately $2.9 billion from these funds. This startling statistic was highlighted in a report released by CoinShares on Monday, marking a pivotal change in market sentiment.

Shift in Investor Sentiment

The significant outflows represent a stark contrast to the previous trend, where digital asset products enjoyed a steady influx of investments. This recent wave of withdrawals has extended a three-week streak, with total outflows now reaching $3.8 billion. According to James Butterfill, a research analyst at CoinShares, several factors are likely driving this sell-off, including heightened investor anxiety following the recent $1.5 billion hack of the crypto exchange Bybit and the Federal Reserve’s increasingly aggressive monetary policy stance.

Profit-Taking Amidst Market Uncertainty

Prior to this downturn, crypto investment products had enjoyed an impressive 19 consecutive weeks of inflows. The current outflows suggest that many investors are choosing to lock in profits as uncertainty looms over the market.

Bitcoin Takes the Biggest Hit

Bitcoin (BTC), the largest cryptocurrency by market capitalization, has been hit hardest by these outflows, losing a staggering $2.6 billion in just the past week. In contrast, funds that take a bearish stance on Bitcoin, known as short Bitcoin ETPs, saw only a modest influx of $2.3 million, indicating that bearish sentiment has not yet fully permeated the market.

Resilience of Alternative Assets

Despite the overall downturn, some assets managed to defy the trend. Sui (SUI) emerged as the standout performer, attracting $15.5 million in inflows, followed closely by XRP (XRP), which also gained fresh investments.

Challenges for Spot Bitcoin ETFs

Spot Bitcoin ETFs have faced one of their toughest weeks to date, with significant capital withdrawals. BlackRock’s iShares Bitcoin Trust (IBIT), the largest Bitcoin ETF, recorded a remarkable $1.3 billion in outflows, marking the highest weekly withdrawal since its inception.

Institutional Positioning Shifts

In addition to ETP outflows, CME Bitcoin futures have experienced a sharp decline in open interest over the past two weeks, dropping from 170,000 BTC to 140,000 BTC. This shift may signal a change in institutional positioning. Meanwhile, the annualized rolling basis for three-month futures is yielding 7%, only slightly surpassing the 4% yield offered by short-term U.S. Treasuries, which diminishes the attractiveness of the trade for investors.

Analyst Insights on Market Dynamics

James Van Straten, an analyst at CoinDesk, noted, «This indicates that hedge funds are beginning to unwind their basis trade positions, which are net neutral.» He added, «With the narrowing spread between futures yields and risk-free returns, traders may be reallocating their capital from Bitcoin derivatives to safer, more liquid assets.»

Conclusion

The current wave of outflows from crypto ETPs highlights the volatility and unpredictability of the cryptocurrency market. As investors navigate these turbulent waters, staying informed about market trends and potential risks is essential for making sound investment decisions.