By Omkar Godbole (All times ET unless indicated otherwise)

The Crypto Landscape in Crisis

The cryptocurrency markets are currently experiencing a significant downturn, mirroring a rising risk aversion in traditional markets—a situation largely attributed to recent tariff announcements made by former President Trump. On Friday, Trump declared a 25% tariff on imports from Canada and Mexico and a 10% tariff on Chinese goods. This move has triggered retaliatory responses, reviving fears of a trade war reminiscent of the turbulent events of 2018.

Temporary Decline or Ongoing Crisis?

While the general consensus among social media users and analysts is that this downturn in the crypto market, particularly for Bitcoin (BTC), is a temporary blip that will soon reverse, there are compelling reasons to view the situation with caution.

Firstly, Trump’s actions have shattered the previous perception that his tariff measures were merely tactical maneuvers intended to negotiate better trade deals. Instead, he has threatened to escalate tariffs further if trading partners respond with their own measures. With Canada and Mexico already committing to retaliation, the risk of additional tariff increases looms large.

Insight from Market Experts

Geo Chen, a macro trader and author of the influential newsletter Fidenza Macro, shared insights with subscribers, stating, «I believe these tariffs will remain in place for several months, with the potential for further increases. Canada has vowed to retaliate, and China has already initiated a lawsuit against the U.S. in the World Trade Organization. These factors could lead to escalated tensions.»

Chen notes that the current tariffs are more significant than those imposed during the previous trade war, affecting $1.3 trillion worth of goods, which is seven times larger than the initial round of tariffs in 2018. Consequently, this situation appears more destabilizing than in the past, thus posing a greater challenge for risk-sensitive assets like BTC.

A Cautious Outlook

As one anonymous crypto trader remarked, “Despite the discussions about potential deals, this situation does not feel temporary.” Investors are advised to remain vigilant.

Upcoming Events to Watch

Crypto Events

— **Feb. 4**: Pepecoin (PEPE) Halving at block 400,000, reducing the reward to 31,250 PEPE.

— **Feb. 5, 3:00 p.m.**: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

— **Feb. 6, 8:00 a.m.**: Shentu Chain network upgrade (v2.14.0).

— **March 11 (TBC)**: Ethereum’s Pectra upgrade.

— **Feb. 13**: Kraken begins the «gradual» delisting of USDT, PYUSD, EURT, TUSD, and UST stablecoins for EEA clients, ending March 31.

Macro Events

— **Feb. 3, 9:45 a.m.**: S&P Global releases January’s U.S. Manufacturing PMI Final report (Est. 50.1 vs. Prev. 49.4).

— **Feb. 3, 10:00 a.m.**: ISM releases January’s Manufacturing PMI Report (Est. 49.5 vs. Prev. 49.3).

— **Feb. 4, 10:00 a.m.**: U.S. Bureau of Labor Statistics releases December’s Job Openings and Labor Turnover Survey (Est. Job Openings 7.88M vs. Prev. 8.098M).

Earnings Reports

— **Feb. 5**: MicroStrategy (MSTR) post-market earnings expected at $0.09.

— **Feb. 10**: Canaan (CAN) pre-market earnings.

— **Feb. 11**: HIVE Digital Technologies (HIVE) post-market earnings.

Token Events and Governance

A number of governance votes and calls are taking place across various DAOs, including discussions within Compound DAO regarding Morpho-powered lending vaults and Arbitrum DAO voting on treasury fund transfers.

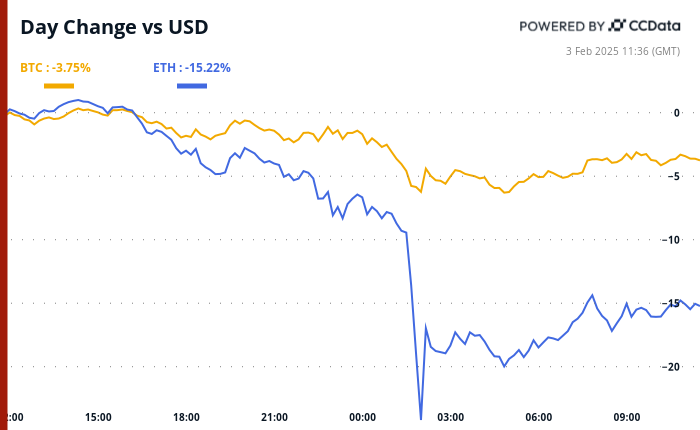

Market Movements and Key Stats

The cryptocurrency market has faced significant declines, with Bitcoin down 6.3% to $95,631.55, and Ethereum down 21.9% to $3,734.92. The CoinDesk 20 index also reflects a decline of 15.9%.

In traditional markets, the DXY index rose by 0.95% to 109.41. Gold remained steady at $2,801.09 per ounce, while silver dipped by 0.31% to $31.28.

Bitcoin Stats and Technical Analysis

Bitcoin’s dominance stands at 61.62%, with a seven-day moving average hashrate of 833 EH/s. The technical analysis indicates that BTC has bounced off the double top support line at $91,384 but could face further declines if it closes below this line, potentially dropping to $75,000.

Crypto Equities Performance

Several crypto-related equities are experiencing downward trends in the pre-market, with MicroStrategy and Coinbase both showing significant declines.

ETF Flows

The daily net flow for spot BTC ETFs reached $318.6 million, with cumulative net flows totaling $40.50 billion. Spot ETH ETFs saw a daily net flow of $27.8 million.

In Summary

The scenario unfolding across crypto markets is complex, influenced by geopolitical factors and economic policies. As traders and investors navigate this turbulent landscape, staying informed and vigilant will be essential to maneuvering through potential pitfalls and opportunities.