Coinbase, established in 2012, has emerged as one of the leading cryptocurrency exchange platforms, largely owing to its user-friendly interface and compliance with regulatory standards. However, many users often ponder how Coinbase generates revenue beyond the apparent transaction fees. Understanding the intricacies of their revenue model can shed light on this often-overlooked aspect of cryptocurrency trading.

How Do Crypto Exchanges Generate Revenue?

Primarily, cryptocurrency exchanges like Coinbase earn money by charging fees on each trade executed on their platform. For example, if an exchange applies a fee of 0.10% (10 basis points) per transaction, a trade of $10,000 would yield $20 in fees, as both parties involved in the trade pay this fee. However, the structure of these fees can be more complex and varies significantly based on several factors.

Fee Structures: A Closer Look

- Tiered Fee Structures: Exchanges often implement tiered fee systems where traders who contribute higher volumes benefit from lower fees. This incentivizes high-frequency traders to consolidate their activities on a single platform rather than distributing their trades across multiple exchanges.

- Maker vs. Taker Fees: Exchanges differentiate between ‘maker’ trades—where liquidity is added to the order book—and ‘taker’ trades, which remove liquidity. Typically, lower fees are applied to maker trades to encourage users to place limit orders.

Example of Coinbase’s Fee Structure

Coinbase’s fee structure is tiered as follows:

| Tier | Taker Fee | Maker Fee |

|---|---|---|

| $0K-$10K | 0.60% | 0.40% |

| $10K-$50K | 0.40% | 0.25% |

| $50K-$100K | 0.25% | 0.15% |

| $100K-$1M | 0.20% | 0.10% |

| $1M-$15M | 0.18% | 0.08% |

| $15M-$75M | 0.16% | 0.06% |

| $75M-$250M | 0.12% | 0.03% |

| $250M-$400M | 0.08% | 0.00% |

| $400M+ | 0.05% | 0.00% |

This tiered system significantly benefits high-volume traders. For instance, a new user placing a $5,000 market order would incur $30 in fees, while a user who has traded $1 million would only pay $9 for the same transaction.

The Importance of Liquidity

Liquidity in an exchange’s order book is vital for smooth trading. A liquid order book allows large trades to occur without drastically affecting market prices. To enhance liquidity, exchanges often incentivize users to place passive limit orders rather than immediate market orders. This is where lower fees for maker trades come into play, as they help maintain a healthier order book.

Real-Life Example

Consider a scenario involving two traders, Alice and Bob:

- Alice, a newcomer, places a limit order to buy $5,000 worth of crypto without urgency. This order enhances liquidity on the exchange.

- Bob, a seasoned trader, wants to sell $5,000 worth of crypto immediately. He places a market order that matches Alice’s limit order.

Alice, as a maker, pays a fee of 0.40%, amounting to $20, while Bob, as a taker, pays a fee of 0.16%, totaling $8. Thus, the exchange earns $28 from this trade.

Estimating Exchange Revenues

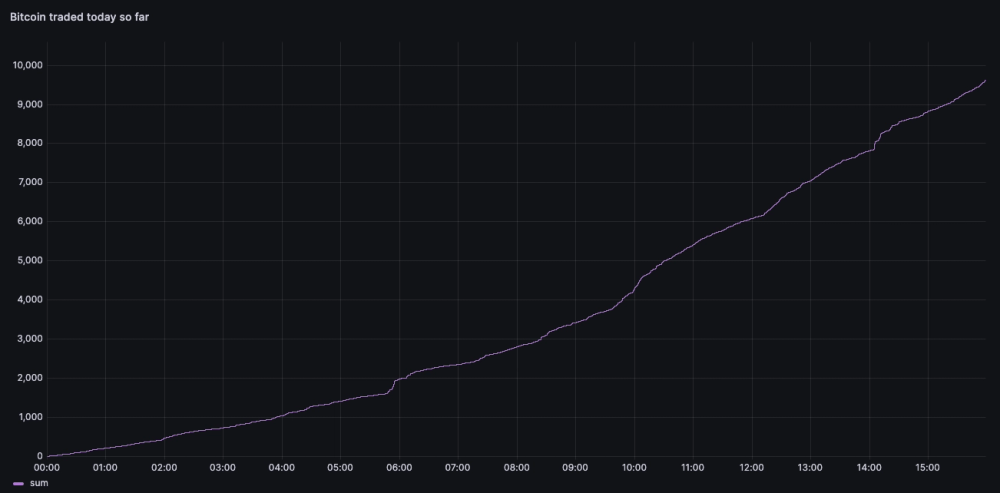

To gauge how much an exchange like Coinbase earns, we can estimate revenues based on reported trading volumes. This involves calculating the cumulative sum of trades over a specific period and applying an average fee estimate. For a practical analysis, tools like QuestDB and Grafana can be employed to visualize trading data.

Practical Steps for Revenue Calculation

- Calculate the total trade volume within a specified timeframe.

- Estimate the average fee based on the available fee structure.

Using these methods, we can derive a comprehensive view of Coinbase’s revenue generated from various trading pairs, not just BTC-USD.

Revenue Breakdown

When analyzing revenues across different trading pairs, it’s evident that BTC-USD generates the highest revenue, followed by ETH-USD and SOL-USD. Notably, the top three pairs can account for a significant portion of an exchange’s total trading revenue.

As we delve deeper into the workings of crypto exchanges, it’s clear that their revenue models are multifaceted and influenced by various factors, including trading volume, fee structures, and market liquidity.