Introduction to the Partnership

Ripple, a leading blockchain-based payment solutions provider, has announced an exciting new partnership with Chipper Cash, a prominent payments platform operating across Africa. This collaboration aims to enhance cross-border payment capabilities into the continent, leveraging Ripple’s innovative technology.

Transforming Cross-Border Transactions

Ripple Payments utilizes XRP, a digital asset designed to facilitate faster, more cost-effective, and efficient cross-border transactions compared to traditional financial systems. With this integration, Chipper Cash—already serving five million customers across nine African nations—will enable users to receive funds from around the globe swiftly and seamlessly. This is particularly significant for those who previously faced lengthy and costly processes for international money transfers.

Statements from Ripple’s Managing Director

Reece Merrick, Managing Director for the Middle East and Africa at Ripple, expressed his enthusiasm about the partnership, stating, “Our collaboration with Chipper Cash marks a key milestone in the expansion of Ripple’s business in Africa. Consumers and businesses across the continent are increasingly recognizing the potential of blockchain technology, and we are excited to bring our crypto-enabled payments solution to our partners in the region.”

Ripple’s Growing Presence in Africa

This partnership is a continuation of Ripple’s strategic efforts to establish a significant foothold in the African market. Earlier in 2023, Ripple joined forces with Onafriq, a payments network designed to link African markets, underscoring the company’s commitment to enhancing payment solutions in the region.

Market Overview

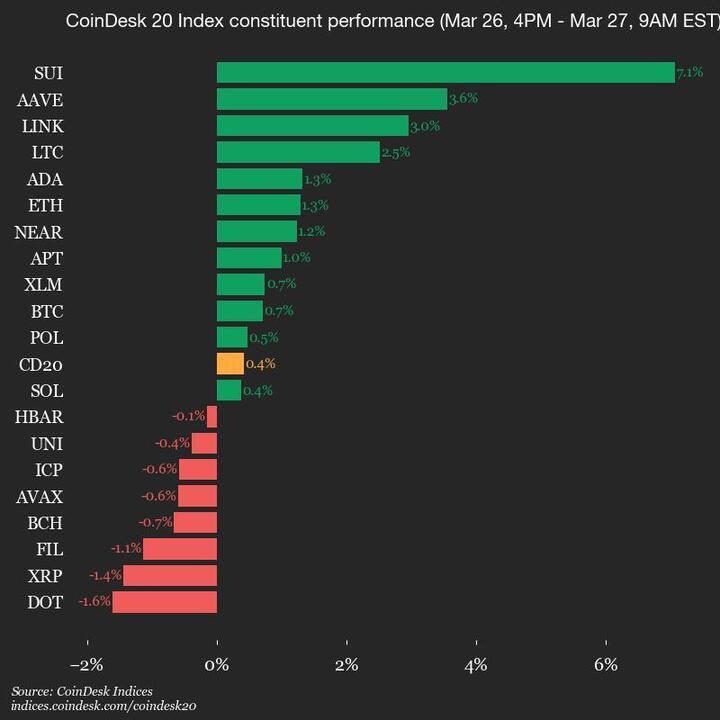

As Ripple makes strides in the African payments landscape, it’s worth noting that XRP has experienced a 4.5% decrease in value over the past 24 hours, reflecting a broader market downturn.

Conclusion

The collaboration between Ripple and Chipper Cash is set to transform how cross-border payments are conducted in Africa, making the process more accessible and efficient for millions of users. As blockchain technology continues to gain traction across the continent, this partnership could pave the way for further innovations in the financial ecosystem.