Importance of Robust Stablecoin Legislation

U.S. Senator Kirsten Gillibrand (D-N.Y.), a prominent advocate for cryptocurrency legislation, has issued a stern warning to the crypto industry regarding the potential for a “watered-down” version of the anticipated stablecoin bill currently under consideration in the Senate. She asserts that strong regulations are essential not only to encourage innovation but also to safeguard investors, particularly in light of recent financial events such as the bank run on Silicon Valley Bank in 2023 and the collapse of the FTX crypto exchange in 2022.

Key Features of the GENIUS Act

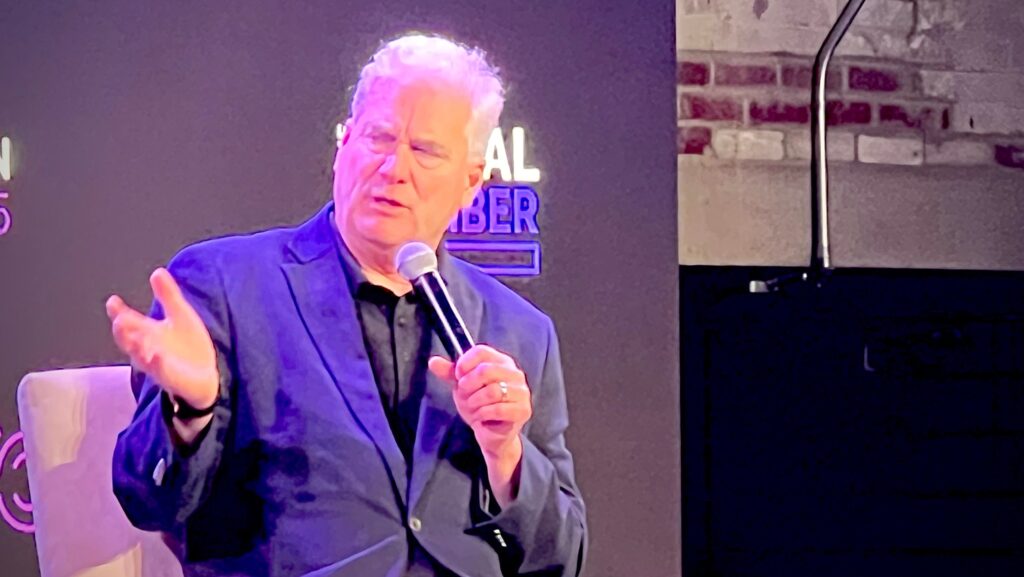

During her address at the D.C. Blockchain Summit in Washington, D.C., Senator Gillibrand highlighted the bipartisan stablecoin bill known as the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act). This legislation aims to implement several consumer protections in scenarios where an issuer may face bankruptcy.

Gillibrand emphasized the importance of careful consideration of potential pitfalls, stating, “You have to think through all the ways this can go wrong.” She pointed out that issues can arise from seemingly simple definitions, such as the distinction between a Treasury and a dollar. She elaborated on the risks involved if a stablecoin’s dollar backing is solely in Treasuries, particularly during periods of interest rate misalignment, which could lead to instability and loss of confidence.

Risks of Inadequate Regulation

Gillibrand warned that failing to enforce strict dollar-backing requirements could lead to problems similar to those experienced with FTX. She said, “You’ll just have another algorithmic stablecoin that plunges because it never really made sense. That is a huge problem for the U.S. market.” She cautioned against the consequences of a diluted bill, asserting, “The worst thing we could do is water it down. Do not think that a watered-down bill will help your industry. It will destroy your industry.”

Legislative Progress for Stablecoins

After several years of stalled efforts, stablecoin legislation seems to be gaining traction. Recently, the U.S. Senate Banking Committee voted to advance the GENIUS Act for a full Senate vote. Additionally, a companion bill from the U.S. House of Representatives is expected to be made public soon.

Gillibrand indicated that if Congress successfully enacts the GENIUS Act, it could pave the way for more comprehensive legislation regarding market structure in the crypto industry. She stated, “A market structure bill is much more complex. It regulates the entire industry, not just one version of a digital asset.”

Future Directions and Challenges

A market structure bill would establish a regulatory framework for the entire cryptocurrency sector, providing clarity for crypto companies and digital asset issuers regarding whether their tokens qualify as securities and determining the appropriate regulatory authority.

During the summit, Senator Bernie Moreno (R-Ohio) expressed his view that any digital asset with a centralized issuer should be classified as a security rather than a commodity. He stated, “If your digital currency has a CEO, it’s not a commodity, by definition.”

Senator Tim Scott (R-S.C.) added that the forthcoming market structure bill must address the complexities beyond the binary classification of security versus commodity.

Moreno has called for the GENIUS Act to be passed before the August recess, challenging his colleagues to expedite the process. He proclaimed, “Let’s get this done by August recess, what do you think? Markets structure, GENIUS Act, [Strategic Bitcoin Reserve], all done by August.”

While Gillibrand acknowledged the urgency, she tempered expectations for a swift market structure bill, affirming that stablecoin legislation is likely to be completed before the summer break, possibly even before the Easter recess in April, “if we’re really productive.”