Introduction to Level’s Expansion

Stablecoin protocol Level has successfully raised a new round of venture capital funding, aiming to enhance its $80 million yield-paying stablecoin. As the crypto market experiences a cooling period, the demand for yield-generating digital asset offerings continues to rise.

Funding Details and Key Investors

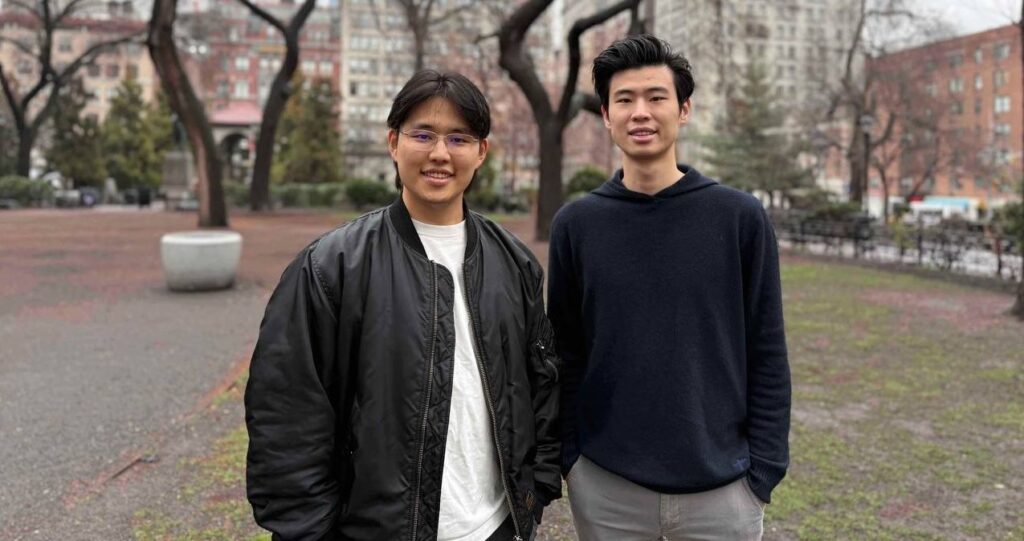

Peregrine Exploration, the development firm behind Level, announced that it secured an additional $2.6 million in funding, led by early investor Dragonfly Capital, with participation from Polychain. In a recent interview with CoinDesk, founders David Lee and Kedian Sun shared insights about the new investors, which include Flowdesk, Echo syndicates, Native Crypto, and Feisty Collective by Path, along with angel investors Sam Kazemian from Frax and Albert Chon from Injective.

This latest round of funding follows a previous raise of $3.4 million in August, bringing the total venture capital funding for Level to $6 million so far.

The Competitive Landscape of Stablecoins

Level, through its lvlUSD token, is carving a niche in the rapidly expanding stablecoin market—one of the most dynamic sectors in the cryptocurrency space and a favorite among venture capitalists. Stablecoins, which are cryptocurrencies pegged to a stable asset like the U.S. dollar, are fundamental to trading and transactions on blockchain platforms. However, many leading stablecoin issuers do not provide yield to users based on the assets in their backing reserves. For instance, Tether reported $13 billion in profits last year, partially derived from U.S. Treasury yields supporting its $143 billion USDT token.

This gap has led to increased interest in a new generation of yield-earning stablecoins. Ethena’s USDe, for example, has surged to a supply of over $5 billion within just a year, utilizing a market-neutral carry trade strategy that harvests futures funding rates. Additionally, tokenized versions of money market funds and Treasury bills have reached a market capitalization of $4.6 billion.

How Level’s Stablecoin Operates

Level’s stablecoin allows investors to earn yield by utilizing the backing assets on decentralized finance (DeFi) lending protocols, such as Aave. The protocol automates reserve management and enables users to mint lvlUSD by depositing Circle’s USDC or USDT stablecoins. Users can then stake these tokens to lend them out, generating yield on-chain. As of last week, the annualized yield for the staked version of lvlUSD was reported at 8.3%, surpassing the yields offered by tokenized money market funds.

Moreover, lvlUSD has integrated with various DeFi protocols, including Pendle, Spectra, and LayerZero, and can be used as collateral on Morpho. Sven Wellmann from Polychain noted, “Their fully on-chain, transparent approach to yield generation sets them apart from competitors relying on opaque, centralized methods.”

Recent Performance and Future Goals

According to Level’s internal calculations, the protocol’s yield offerings have outperformed those of competing stablecoins over the past month. This success has contributed to an impressive supply exceeding $80 million just five months post-beta launch.

With this new funding, Level plans to enhance its team and marketing efforts while simultaneously expanding the utility of lvlUSD beyond just staking. Kedian Sun elaborated on the protocol’s strategy, mentioning plans to leverage Morpho for yield generation in the upcoming weeks.

Aspiring for Greater Heights

With these initiatives, lvlUSD is on a trajectory that could potentially push its market cap towards $200-$250 million, a significant milestone that the team is eager to achieve, according to Sun.