THORChain’s Strategic Move to Convert Debt into Equity

In a decisive move to address nearly $200 million in unmanageable debt, THORChain’s community has approved “Proposal 6.” This proposal aims to convert the existing debt into equity through the issuance of a new token, known as TCY (Thorchain Yield), with a total supply capped at 200 million tokens. This innovative approach is designed to stabilize the platform’s financial situation and provide a pathway for recovery.

Suspension of THORFi Services Sparks Urgent Action

The decision to issue TCY tokens follows the suspension of THORFi services on January 23, which was necessitated by ongoing financial uncertainties. In light of these developments, THORChain’s leadership has taken proactive steps to safeguard the interests of its users and investors, as reported by CoinDesk.

Distribution and Liquidity Pool Plans

The distribution of TCY tokens will occur at a rate of 1 TCY for every dollar of defaulted debt. This means that lenders and savers will be transformed into equity holders, allowing them to have a stake in the future of THORChain. To further enhance liquidity, THORChain plans to establish a RUNE/TCY liquidity pool, initiating with $500,000 at a price of $0.1 per TCY. This liquidity pool will be funded by $5 million sourced from the platform’s treasury.

Long-Term Incentives for TCY Holders

One of the most appealing aspects of holding TCY tokens is the promise of receiving 10% of THORChain’s revenue indefinitely. This revenue-sharing model is designed to provide a sustainable long-term incentive for those adversely affected by the debt crisis. However, it is important to note that the timeline for complete financial recovery remains uncertain.

Cross-Chain Swaps Remain Operational Amid Challenges

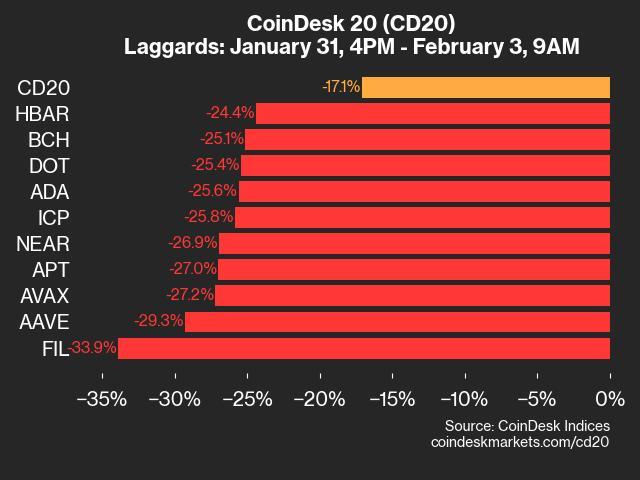

Despite the financial turmoil, THORChain’s core service—cross-chain swaps—continues to operate without disruption. However, it is worth mentioning that the platform’s native token, RUNE, has experienced a decline of 10% in value over the past 24 hours, reflecting a broader market downturn. This drop has compounded the losses over the past month, bringing the total decline to nearly 50%.

In summary, THORChain’s initiative to convert debt into equity through the issuance of TCY tokens represents a bold strategy to navigate through financial challenges while maintaining essential services. The community’s response and the effectiveness of these measures will be critical in determining the platform’s future stability and growth.