Cryptocurrency: A Commodity or a Security? Understanding the Implications

In today’s digital landscape, cryptocurrency has emerged as a significant player in the world of finance. Defined as entirely digital assets that can be bought, sold, or traded, cryptocurrencies derive their value from the dynamics of supply and demand. While many are familiar with prominent names like Bitcoin, Dogecoin, and Ethereum, the categorization of these assets remains a hot topic of debate.

How Cryptocurrency Operates

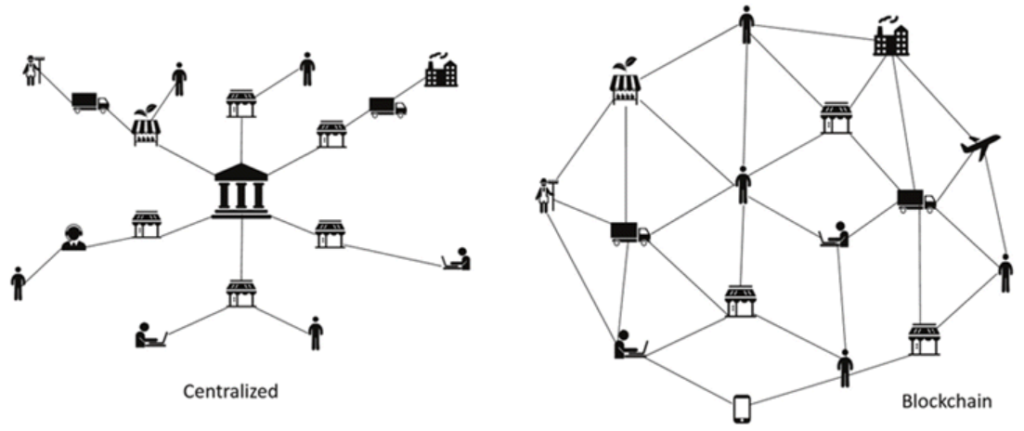

Unlike traditional currencies, cryptocurrencies are not issued or regulated by central banking institutions. Instead, they function within a decentralized, peer-to-peer system, facilitated by blockchain technology. But what exactly is a blockchain? In essence, it is a secure digital ledger that records all transactions, akin to a massive shared receipt that gets updated with every new transaction.

Is Cryptocurrency a Commodity?

Traditionally, commodities are raw materials like sugar, iron, or gold, which can be traded in standard units. Cryptocurrencies exhibit similar characteristics; they are interchangeable, with each token or ‘coin’ being identical to another. Additionally, they are decentralized, allowing users to trade directly with one another. The Commodity Futures Trading Commission (CFTC) typically regulates such commodities.

Or Is It a Security?

Securities encompass stocks, bonds, and mutual funds, and they are characterized by the potential for profit or loss based on an exchange between two parties. Cryptocurrencies can be likened to securities since they can be issued in a manner similar to stocks. This is particularly evident in Initial Coin Offerings (ICOs), a fundraising mechanism for new cryptocurrencies. Unlike commodities, securities are usually regulated by the Securities and Exchange Commission (SEC).

The Classification Debate

The classification of cryptocurrencies often hinges on their specific nature. The CFTC and SEC generally categorize Bitcoin and Ether as commodities due to their ability to be traded on both traditional and cryptocurrency exchanges. However, SEC Chair Gary Gensler has expressed that many cryptocurrencies should be classified as securities to enhance investor protection against fraud and market manipulation.

This perspective has sparked contention, particularly from Republican Rep. Tom Emmer of Minnesota, who argues that most cryptocurrencies should remain classified as commodities, thereby exempting them from SEC oversight.

Why Does This Matter?

The classification of cryptocurrencies is crucial for their future. If deemed securities, they would fall under the SEC’s jurisdiction, subjecting them to stringent regulations regarding price transparency, reporting obligations, and market abuse controls. While this may provide greater investor protection, it could also stifle market innovation and freedom.

Conversely, if classified as commodities, the regulatory framework would be more lenient, granting investors greater autonomy. However, this scenario comes with heightened risks. A recent example includes Coinbase’s announcement of a product called Lend, designed to allow users to earn interest on specific cryptocurrencies. This initiative was paused after the SEC suggested it may classify the offering as a security.

Staying Ahead in an Evolving Market

The ongoing debate over the classification of cryptocurrencies highlights the challenges surrounding regulatory approaches and the degree of protection investors should have in this emerging and volatile market. Although cryptocurrency has yet to achieve mainstream status, the potential for increased regulations may lend legitimacy to these digital assets. As the landscape continues to evolve, it’s essential for individuals and businesses alike to stay informed and adapt to the changing environment.