The Landscape of Cryptocurrency Legislation

As 2023 unfolds, a notable surge in interest from U.S. states to invest public funds in cryptocurrencies has emerged. This movement seeks to establish a foothold in digital assets before the federal government can create a strategic reserve. However, the progress has been uneven, with five states already experiencing setbacks, while Utah stands just one vote away from potentially passing its legislation. Meanwhile, Texas has also made strides by advancing a bill to its state Senate.

Failed Legislative Efforts Across Multiple States

Several states, including Pennsylvania, Wyoming, Montana, South Dakota, and North Dakota, have attempted to introduce legislation aimed at investing public funds in cryptocurrencies. Unfortunately, these initiatives have failed to gain traction. In contrast, states like Utah have made notable progress in their legislative efforts, reflecting a rapidly evolving landscape.

The Push for a Federal Digital Asset Reserve

The discussion surrounding a federal strategic reserve for digital assets has gained momentum, fueled by voices from Congress and notable figures like former President Donald Trump. The idea was notably highlighted during the Bitcoin 2024 event in Nashville, Tennessee, prior to Trump’s election. Advocates for this concept include MicroStrategy’s Michael Saylor and Senator Cynthia Lummis from Wyoming, who chairs the Senate Banking Committee’s crypto subcommittee.

Market Fluctuations Impacting State Initiatives

Despite the urgency among states to act quickly, recent developments have seen a significant decline in the value of Bitcoin (BTC), which is at the center of many state initiatives. The price has dropped from a high of $106,000 on inauguration day to around $86,000, coinciding with a major hack at the Bybit exchange that resulted in the theft of a historic amount of cryptocurrency. These events have likely dampened enthusiasm among state government proponents.

A Shift in Urgency

Johnny Garcia, managing director at VeChain Foundation, notes that the initial sense of urgency surrounding state-level cryptocurrency investments seems to have subsided. «States have some breathing room to assess and contemplate a way forward,» he stated, indicating a potential shift in focus.

Mixed Results in Legislative Votes

Montana and North Dakota have experienced clear defeats in their attempts to establish state-level crypto reserves, with both legislatures voting against the proposed bills. In the other three states where similar initiatives failed, rejections occurred at the committee level.

Utah’s Legislative Progress

On a more positive note, Utah has advanced legislation that would permit crypto investments of up to 5% of specific public accounts. This bill has successfully cleared the state house and a senate committee, positioning it for consideration by the entire state senate. However, the outcome remains uncertain, as legislative windows can be limited.

Dennis Porter, CEO of the Satoshi Action Fund, underscores the dynamic nature of this process. «Although Utah seems best positioned to finalize its bill first, nothing is guaranteed,» he remarked.

The Role of States as Laboratories of Democracy

Porter emphasizes the importance of states acting as «laboratories of democracy,» where innovative ideas can be tested. He acknowledged that while many of the proposed bills are likely to fail, this is a normal part of the legislative process. His organization remains committed to advocating for state-level cryptocurrency initiatives in the coming years.

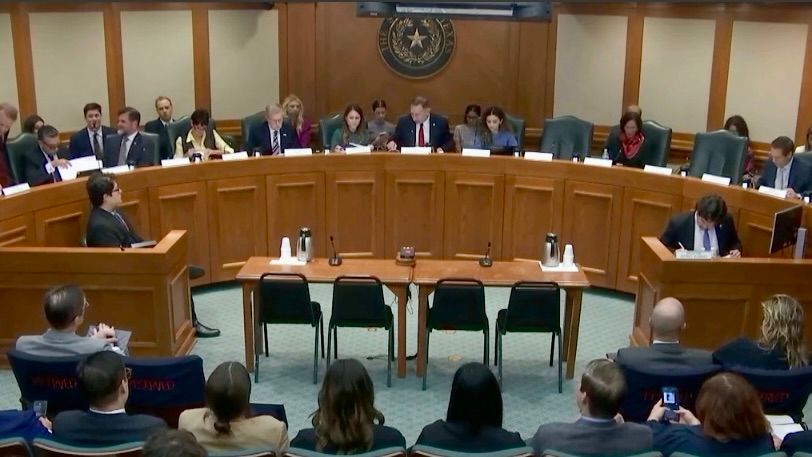

Texas and Other Emerging Efforts

Texas has made headlines as the latest state to move a cryptocurrency reserve bill out of committee, reflecting its status as a major hub for Bitcoin mining. However, the variety of digital asset initiatives across states makes it challenging to identify a unified approach. For instance, Indiana’s House has passed a bill focused on using blockchain technology to enhance government efficiency, while Arizona is advancing legislation to keep unclaimed property in cryptocurrency rather than converting it to cash.

Encouragement for Future Investments

Despite North Dakota’s failed reserve effort, the state house has approved a resolution encouraging its treasurer to invest certain state funds in digital assets. This resolution is currently awaiting consideration by the state senate.

Looking ahead, Garcia predicts that many states are likely to authorize digital assets as part of their state pension and investment options before progressing toward more aggressive digital asset reserves. The shifting dynamics in the cryptocurrency landscape suggest that while challenges remain, opportunities for innovation and investment are on the horizon.